Industry Experts Weigh in on What’s New & Now

By Leo J. Procopio, Paintology Coatings Research LLC

Architectural coatings consist of a wide array of paints and coatings for both interior and exterior surfaces found in residential and commercial buildings. Surfaces being painted include drywall, concrete block, wood, brick, stucco, metal, and others. Applications include primers and paints for walls and ceilings, stains and coatings for exterior decks, interior wood stains and sealers, floor coatings, basement waterproofers, and trim paints, among others.

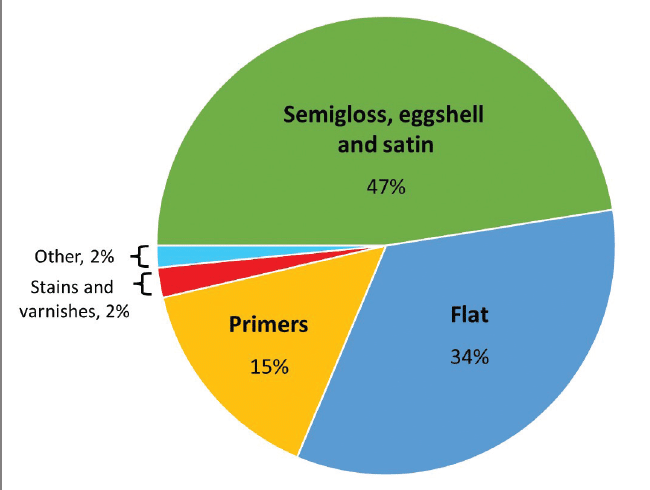

As a group, architectural coatings comprise the largest segment of the U.S. paint and coatings market, approximately 60% by volume and 50% by value.1,2 The total volume of architectural coatings is estimated at approximately 900 million gallons for 2021.3 Roughly two-thirds of the total volume is applied in interior spaces, and waterborne latex is the dominant technology. About 85% of the interior coatings are waterborne, and they can be divided up into the types of coatings shown in Figure 1.

Figure 1—Approximate breakdown by volume of waterborne interior architectural coatings for the U.S. market in 2020.1

During the past two years, the paint industry has not been a stranger to the turmoil caused by the COVID-19 pandemic, raw material shortages, and supply chain disruptions. The architectural coatings segment has actually seen some positive effects from the pandemic, as consumers spent more time at home and focused more energy and money towards do-it-yourself (DIY) home remodeling.

The percentage of painting done by DIYers versus professional painters increased, reversing a trend of many years. Professional painters were applying approximately 60%-65% of the paint before the pandemic. After the pandemic initially hit, professional painters were given less access to homes and commercial sites due to safety concerns. Paint application by DIYers increased in 2020 to an approximately 44% share,3 but professional painting has increased since 2021.

Driven by robust demand in the DIY segment, the overall growth in architectural coatings has been strong for 2020 and 2021. It is estimated that the U.S. architectural coatings market grew by 3.8% in 2020, with the DIY segment growing by approximately 15%.1 The trend will probably continue in 2022.

Looking at home remodeling as a leading indicator, growth is expected to peak in 2022, according to the recent Leading Indicator of Remodeling Activity (LIRA) released by the Remodeling Futures Program at the Joint Center for Housing Studies of Harvard University.4 The LIRA projects double-digit gains in homeowner renovation, with maintenance expenditures peaking in the third quarter of 2022 before beginning to return to more sustainable levels.

Of course, the industry is also still dealing with headwinds such as raw material shortages and supply chain disruptions. Against this backdrop of two years of growth in spite of the pandemic as well as remaining headwinds, CoatingsTech asked several paint manufacturers for their views on the interior architectural coatings market.

In the Q&A section that follows, they provide comments on how the pandemic affected the interior coatings market and talk about trends influencing product development and consumer aesthetic choices. They also describe recently introduced products and offer thoughts on the importance of topics such as online ordering and sustainability for the future of interior coatings.

The industry experts providing comments include:

- Jodi Allen, global chief marketing officer at Behr Paint Company

- Derek Ward, vice president of operations at Farrell-Calhoun Paints

- Daniel Claybaugh, vice president of marketing and business development at Kelly-Moore Paints

- Kyle Mooney, product management director for architectural coatings at PPG

Q. What effect has the ongoing pandemic had on the interior paint market? Has it affected the DIY versus contractor-applied markets differently?

Mooney, PPG: The pandemic transformed our homes into gyms, classrooms and offices, while also remaining our primary living space. As we continue to spend more time at home, it’s only natural that homeowners are taking a closer look at the functionality of their homes. Consequentially, home improvement projects surged in 2020 and 2021, including purchases of both interior and exterior paint. Notably, online paint sales were boosted as a result of the pandemic, a trend that has continued this year. After elevated DIY product sales spiked at the height of the pandemic, demand for those products has expectedly contracted back down to 2019 levels. We believe there is more upward growth potential in the DIY paint space as we move through the year and supply chain constraints are alleviated.

Reverse urbanization nationwide was another result of the pandemic as millennials and younger generations entered the home buying market earlier than expected. The increase in home buying has established a strong demand for paint and an increase in residential jobs for professionals (pros). In addition to an uptick in demand for pro painters in the residential space, we also see increased opportunity for pros in the commercial sector, as the world continues to re-open and patrons are returning to places like hotels and restaurants.

Claybaugh, Kelly-Moore: The pandemic has definitely had an impact on supply chain disruption for all paints and coatings. But the bigger disruptor has been the 2021 freeze in the Southwest that caused the great raw material shortage; a perfect storm in a high-demand market. Transportation has played a key role in supply chain disruption as well. Many truck drivers have been recruited to other industries and companies like Amazon and Walmart because of the need for drivers in this inflationary period.

Ward, Farrell-Calhoun: The pandemic has increased the overall paint market. Customers have been painting more during the pandemic, because they have more time and money. Historically low interest rates, a strong stock market and an influx of government supplied money has fueled the market. The pandemic has also caused supply shortages, supply chain problems and labor shortages to date. Farrell-Calhoun experienced historically high DIY sales early in the pandemic, and strong DIY and contractor sales since mid-2021. Overall paint supply has been problematic since Ice Storm Uri froze the Gulf Coast. The biggest factor is availability on both fronts.

Allen, Behr: Over the past couple of years, the pandemic has contributed to a growing DIY market as an insurgence of millennials and first-time painters entered the category. With people continuing to work from home, many are finding renewed energy to take on paint refreshes, particularly in spaces where we’re spending a lot of time, like the home office, kitchen, and living room. More recently, there has been a steady increase in professional projects as consumers are feeling more comfortable opening their homes to professional painters.

Q. What are some of the key trends or drivers that are influencing your product development efforts for interior architectural coatings? Are these trends/drivers different for commercial versus residential applications, or for paints applied by DIYers versus contractors?

Ward, Farrell-Calhoun: Product development has been very slow during these times due to lack of available raw materials, allocations and labor shortages. Most of the time that was traditionally used for development was allocated towards production and raw material procurement. The biggest driver has been what resin can we actually get. We would like to have launched some new products but could not get resin for them and had no lab time to develop anything.

Mooney, PPG: The pandemic has brought health and hygiene to the forefront of everyone’s minds and increased awareness of the benefits of antibacterial and antiviral coatings. These innovative products can provide supplemental protection from germs that live on surfaces between regular cleanings, and they can be used in both residential and commercial spaces.

Claybaugh, Kelly-Moore: Painting contractors need products designed for ease of application and product performance. It is important to target specific segments with the right working properties that are required for that specific segment at a price point to be competitive in the market. It really boils down to application properties, hide, and durability. If we can build a better technical solution to meet these key objectives, while reducing raw material cost, that’s a winning combination.

Q. What are the most important properties end-users should focus on when selecting an interior coating and comparing paints from different manufacturers?

Claybaugh, Kelly-Moore: It depends on the objective of the project. If the objective is to clean up a house for sale, the end-user wants something that will hide well at an economy price. If you are buying a home, you may want a higher-quality product that will hold up to kids and everyday life for several years and if you are willing to pay more for that result. If it is for new residential housing, the product must hide and touch up at a commodity price point. So, depending on the objective of the project, application, hide, product attributes and price will vary based on the job type.

Ward, Farrell-Calhoun: Normally we would focus on hiding, touch-up, and flow, but currently it is more about who has product in stock. I would add that using the higher sheen paints in highly traveled areas for better overall wear and cleanability is an important consideration. For interior trim work, make sure that surface preparation and an appropriate primer (if needed) is used to ensure adequate adhesion to the previous coat. Most paint failures are due to lack of surface preparation on previously painted surfaces. Flat wall paints are normally easy to paint over, while trim enamels are not.

Q. What new products have you introduced recently, and what unique properties do they bring to the interior coatings market?

Allen, Behr: Last year we introduced BEHR DYNASTY™ Interior Paint, the brand’s most stain-repellent, scuff-resistant paint that is fast-drying with the added benefit of one-coat hide. This latest product innovation delivers beautiful and durable results that stand up to any project and provides users with everything they could want in a paint, now all in one can. The product addresses the needs of DIY, design, and paint professionals today when it comes to durability, application, and time.

Additionally, KILZ® Mold & Mildew Primer is another offering we introduced recently to further improve product quality and adhesion. This water-based primer is a perfect solution for spaces like kitchens, bathrooms, and laundry rooms, as these are prone to high humidity, moisture, and temperature. The primer formula creates a mold- and mildew-resistant film that protects the primer film from mold and mildew growth.

Ward, Farrell-Calhoun: New product introductions have been complicated by the difficulty in procuring resin. Our latest product that preceded the pandemic was our Enamelex Satin Interior Trim line, which exhibits excellent adhesion to a variety of previously painted, properly prepared substrates.

Mooney, PPG: In October 2021, PPG received U.S. Environmental Protection Agency (EPA) registration for its PPG Copper Armor™ antimicrobial paint containing Corning® Guardiant® technology, proven to kill 99.9% of bacteria and viruses on painted surfaces, including SARS-CoV-2, the virus that causes COVID-19, in two hours.* The Copper Armor product’s efficacy was measured using tests that simulate real-world contamination that are mandated by the EPA for products making claims against harmful pathogens. PPG is now pursuing state-by-state registration with the EPA.

PPG Copper Armor paint was developed for use in high-traffic areas such as health care, hospitality, office, and educational environments, as well as residential locations. In addition to its anti-viral technology, the product also provides a mold- and mildew-resistant coating on the dry paint film.

PPG Copper Armor is available for sale on a state-by-state basis. Available in eggshell, satin, and semi-gloss, PPG Copper Armor can be tinted to more than 600 colors from the PPG paint palette.

Claybaugh, Kelly-Moore: Kelly-Moore has introduced a few new products recently. Kel-Bond Quick Sand is an extremely fast drying, easy-to-sand waterborne primer designed for interior fine wood finishing. This product allows quick turnaround on doors, trim, and cabinets so that they can be put back into use the same day. Kelly-Moore’s premium Ceiling Paint is a flawless dead flat finish intended to diffuse light and hide imperfections across a variety of ceiling surfaces. This product is very low-odor and low-VOC so that it can be used in occupied spaced. It is also non-bridging for use over acoustic tiles.

Our high-performance DTM is a single-component waterborne coating that provides a smooth, durable finish over a variety of metal surfaces. The self-priming formula provides superior adhesion, outstanding corrosion resistance, and long-lasting UV protection. Its corrosion-inhibiting properties allow for application over light surface rust and reduce preparation time. Kelly-Moore’s Inspire Interior is an economical solution for the residential repaint and DIY customer. Designed to provide a smooth, beautiful finish with lasting durability, the self-priming, high-hide formula allows for easy application in fewer coats. The stain-resistant, easy-to-clean finish keeps surfaces looking better for longer.

Q. What do you see as the trends in color choice, and what influences end-users most in their ultimate choice? Do you have a color/palette of the year for 2022?

Ward, Farrell-Calhoun: White/off-white wall and trim with a black/bronze-tone accent still dominate the current paint color palettes. Most new houses and most repainted houses have been using this color scheme for the past five years or so.

Farrell-Calhoun’s Color of the Year for 2022 is Mellow Blue 0468 (Figure 2). Simple and fresh, Mellow Blue restores a sense of newness, ease, and balance. Mellow Blue provides a break in the clouds, a gentle optimism, and it is the renewing color of self-care and mindfulness, enhancing calm that nourishes well-being in any interior or exterior. With a promise of the vibrancy and ease of nature, this soft green blue doesn’t overwhelm but instead inspires present-time focus and encourages restored confidence.

Claybaugh, Kelly-Moore: Instead of choosing a single color for 2022, we are focusing on color trends we see making the scene this year. Our blog at kellymooreshop.com/blogs/our-blog has two articles on our 2022 Color Trends and describes the colors that bring those trends to life. We also have a whole page of exterior color scheme articles to help homeowners find their perfect color palettes with confidence. The most popular articles include one “typical” style house that we render in several color schemes to show readers all the ways they can imagine their homes and maybe even find their perfect palette right in the article.

We’ve created several color tools to help people get to their perfect colors faster and easier. And we sell them all online now. Look for our two beautiful, easy-to-carry-in-your-purse fan decks, THE essential COLOR SET with 100 of our top-selling home colors, and THE Historic COLOR SET with 110 vintage colors that definitely feel fresh today. We also just launched our 8 ½ x 11 COLOR swatches in all 1,721 of our amazing colors. Now consumers can order these big, gorgeous sample pages of color to help them envision in their color ideas. Most people order three or four samples in similar colors so they can decide which version will look best in their space. And we have our COLOR Swatch Collections where we’ve pre-selected seven trending color families to help consumers get excited about seeing their room in a whole new light at KellyMooreShop.com.

Allen, Behr: Last summer, we announced the BEHR® 2022 Color of the Year, Breezeway MQ3-21, which is an approachable silvery green that lives within the BEHR® 2022 Color Trends Palette (Figure 3). Breezeway evokes feelings of tranquility and peace while representing the intention to move forward. With its timeless appeal and versatile nature, Breezeway has enough personality to go from casual to coastal and modern to vintage styling. The seasonless hue seamlessly pairs with other colors in the 2022 palette to create unique looks and moods that appeal to any decor style.

The 20-color palette collection consists of soothing and grounding hues to help provide a peaceful sanctuary in any space. You’ll see colors from frosty gray-blue Wave Top M450-3, to softened black Cracked Pepper PPU18-01, and earthy terracotta Basswood MQ2-46, among others.

Mooney, PPG: During difficult inflection points throughout history, we often see consumers gravitate toward more colorful selections, as previously seen during the Roaring Twenties or after the Great Depression. As part of this cyclical history, PPG is seeing post-pandemic optimism start to infiltrate residential design spaces to create a sense of escapism. Just as trends in the 1920s were marked by opulence, metallics, rich woods, layers, moody colors, and angular shapes, today’s home décor is drawing inspiration from the Antiquity, Baroque, and Renaissance eras of art, sculpture, and architectural forms. This colorful embrace is thought to reflect an optimistic rebellion, a sign of personal expression, or soothing self-care.

In 2022, we anticipate that homeowners, designers, and architects will opt for more colorful palettes, shifting from the neutral, minimalist palettes of the last few years. Olive Sprig (PPG1125-4), PPG’s 2022 Color of the Year, is a soft, muted green that’s both elegant and grounded (Figure 4). It’s a highly versatile shade that emulates nature’s resiliency and brightens any space with its natural liveliness. Olive Sprig represents the tone of 2022 as it embodies the regrowth and renewal that we’re all craving.

In addition to the Color of the Year, PPG’s color experts have also identified three color stories that will resonate for homeowners, designers, architects, and facility and property managers in 2022:

Invaluable. The Invaluable palette culminates a rich library of cultural references to imagine its perfect place in today’s world. Drawing Gatsby-esque inspiration from the past to create the go-to glamorous palette of the present, this color story is not afraid to be bold. Grounded with rich hues like PPG’s Gooseberry, Castle Stone, and Ancient Copper, the Invaluable palette adds depth and warmth to any space. Pair these colors with rich, dark woods and brass accents to really turn up the drama—especially in the home, restaurants, or hotels.

Introspective. The Introspective color story is for those that prioritize self-care and appreciate life’s simple pleasures. Create a serene and intimate space with colors like PPG’s Tea Time, Peace, Silver Service, and Pine Whisper, which complement the soothing comfort of Olive Sprig. These hues are perfect for the private yet soulful consumer looking to create an ethereal bedroom retreat, a thoughtful office space, or add a hint of color to an otherwise neutral-toned kitchen.

Inspired. Those drawn to the Inspired color palette cannot be pinned down. These mood-boosting shades are sure to turn up the volume in any space and add an optimistic jolt of energy for spaces that need it most—like a statement-making front door, a unique retail environment, or an inspiring child’s playroom. PPG’s Cenote, Aloha, and Lettuce Alone offer liveliness and mimic high-tech greens and blues that are sure to turn heads. Warm hues like Paris Pink, Coral Silk, and Crushed Pineapple are perfect picks for the confident, social, and adventurous painter who wants to spread joy, embrace change, and break free from minimalist designs of years past. PPG’s Olive Sprig acts as a muted neutral in this palette to ground the bolder, brighter-color counterparts.

Q. What will be the role of online versus in-store purchasing of architectural paint will be in the future?

Allen, Behr: In-store and online both remain highly active pathways to purchase paint. Although we have seen significant growth in our ecommerce business, our focus is on improving the interconnected experience to create a seamless integration from online to in-store. We continue to leverage our partnership with The Home Depot to improve experiences for DIYers and pros including the successful launch of BOPIS (buy-online-pick-up-in-store). These types of programs and initiatives will be ongoing as we continue to focus on improving the paint purchase journey.

Claybaugh, Kelly-Moore: The pandemic has accelerated the incorporation of online shopping for architectural paint. It’s now becoming the “cost of entry” in the industry. While it still represents a nominal amount versus brick-and-mortar sales, it continues to grow every year. Homeowners are now able to start a project from the comfort of their home online, then visit the local paint store to pick up their paint and supplies from their online order. Contractors are seeing the time savings and accuracy from placing online orders for pick up or delivery.

Mooney, PPG: According to research commissioned by PPG in partnership with the Cleveland Research Company, in the next three years it is estimated that professional painters will make more than half of their purchases online, seeking faster, more cost-effective ways to purchase products. In fact, 70% of pro painters have already started placing more orders online and/or had paint delivered to a job site as a direct result of the pandemic. Two-thirds of those pros are expected to continue to order online in the future. Additionally, the research found that pro painters use their phones to conduct research on paint in store more often than in any other construction category, and they are now making 1.5 times more paint purchases online than in any other category across home improvement.

To proactively address the evolving needs of professional painters, PPG launched e-commerce ordering capabilities available to pro painters globally. The new U.S. model offers improved convenience and ease of purchase through digital ordering at PPGpaints.com. In addition to ease of ordering, the platform also offers more options for having orders delivered directly to the job site. Through our improved e-commerce platform and digital order fulfillment, PPG is able to deliver the right product, to the right place, at the right time; enable customers to order paint anytime, anywhere 24/7; and ensure that pros never have to leave the job site therefore increasing productivity, output, and ultimately allowing them to grow their top line.

Ward, Farrell-Calhoun: We still see in-store purchasing dominating. We expect online purchasing to be a factor, but there are some problems with online ordering. Colors are not represented properly on a computer screen, so it is hard to order colors without having a physical representation of the color. Wet samples are easily shipped after online ordering, but paints are problematic to ship due to the weight of the product and the damage that incurs when it is not handled properly, and product returns are problematic and unwanted by the retailer.

How do the concepts of green technology and sustainability affect end-users’ attitudes toward a paint brand, and how is your company responding for your interior paint lines?

Claybaugh, Kelly-Moore: The environment is in the forefront of the minds of most consumers and continuing to leverage green technologies and sustainability is good for the market and the brand. Kelly-Moore Paints continues to scan the horizon for the most innovative technologies and ways to improve processes in conservation. Recently we installed a water recycling program that cleans wastewater that can then be safely disposed. Any Kelly-Moore product development must meet or exceed the most stringent environmental regulations in the country regardless of where it is sold.

Ward, Farrell-Calhoun: The biggest factor right now is availability, but consumers, contractors, and architects are continually driven towards green technology, sustainability, lower odors, and lower VOCs. Contractors are also concerned with performance, price, and availability.

Farrell-Calhoun has continued to work towards lower-odor and lower-VOC options with equal or better performance. Interior trim enamels are the area where we have seen the most advancement in this area. Changes in resin technology to incorporate ambient cure technology and better emulsion polymerization have allowed the formulator to decrease co-solvent loading and maintain or increase overall hardness of the coating.

Most waterborne paint resins are derivatives of petroleum and natural gas, but these resins have been processed to provide lower VOCs and lower-odor paints. There are waterborne alkyd emulsions based on oils such as soybean that are derived from a renewable source and are used in some trim enamels. Solventborne alkyd resins are also based upon oils, but these products are much higher in VOC content. All paints will emit some type of odors, and it is proper for consumers to understand the need to ventilate areas after they paint to remove unwanted odors and chemicals that are emitted from the paint after application.

Mooney, PPG: We remain steadfast in our commitment to serve the communities where we operate and develop innovative products and sustainable solutions that create value for our stakeholders. In 2020, 35% of PPG sales came from sustainably advantaged products and processes. Our products and processes help make our customers, and the world, more sustainable. Some recent examples of this sustainability in action include increased offerings of antibacterial and antiviral coatings.

The PPG Sustainability Report is available online at https://sustainability.ppg.com.

Allen, Behr: Environmental awareness and efforts are on the rise, and we’re working toward making relevant information easily accessible to consumers, contractors, architects, and designers across our digital platforms and in-store offerings. More recently, we introduced the new BEHR Simple Pour Lid—a 100% recyclable lid designed to reinvent traditional metal paint can lids and offer an eco-friendly approach while helping to make the painting process more convenient. Additionally, more than 40 BEHR® and KILZ® products are certified by UL Environment’s GREENGUARD Gold and Formaldehyde Free Claim Validation.

References

- Linak, E.; Kishi, A.; Guan, M.; Bucholz, U. “Paint and Coatings Industry Overview.” IHS Markit, July 2021.

- Pilcher, G.R. The State of the U.S. Coatings Industry 2021. CoatingsTech, August 2021, pp. 30–41.

- “ACA Industry Pulse: Architectural Coatings, 2021 Q2,” American Coatings Association, July 2021.

- The Joint Center for Housing Studies of Harvard University website. Leading Indicator of Remodeling Activity (LIRA) and the Remodeling Futures Program. https://www.jchs.harvard.edu/research-areas/

remodeling/lira (accessed Mar 8, 2022).