By Cynthia A. Gosselin, Ph.D., The ChemQuest Group

In the past several years, many in-depth articles have been written across the industry heralding a wide variety of advances suggesting that biobased materials were on the verge of achieving explosive growth.

Some of these coatings manufactured from “natural” or ecofriendly sources are commercial and manufacturing success stories. Yet, many other developments and advancements are still waiting for the right resin, application, or manufacturing opportunity to manifest itself.

In 2019, an in-depth look at the role that academia plays in successfully making coatings “benign by design” hinted that success in mass utilization of biobased coatings must include a several pronged industry-wide approach.1

Following up on those observations, this article further examines today’s biobased coatings world from the perspective of sustainability, standardization and industry/government/university collaboration as a basis for progress moving forward.

The Coatings Industry Sustainability Challenge

Since the turn of the century, every industry has made efforts to some extent to build sustainability into their product portfolios with varying degrees of success. Recycling was one of the initial movements to gain traction.

Simply put, if things could be reused or reinvented as a new use, less would end up in the burgeoning landfills—sort of like hand-me-downs of previous generations, but on a much wider scale.

Over the past 20 years, sustainability has evolved into a much more complex paradigm with four main pillars encompassing human, social, economic, and environmental interactions. Together, these four pillars intertwine to personify sustainability defined by the Oxford English Dictionary as “the avoidance of the depletion of natural resources in order to maintain an ecological balance.” Merriam-Webster further describes sustainability as “a method of harvesting or using a resource so that the resource is not depleted or permanently damaged.”

The coatings industry first approached sustainability through reductions in manufacturing emissions and commercially successful product developments such as water-based technologies that lowered VOCs.

Lately, the industry has continued sustainable market-wide initiatives by developing a portfolio of biobased coatings. These products attempt to substitute raw materials derived from fossil fuels with products made from plant-based biomass raw materials such as vegetable oils or sugars.

Key components of these initiatives are rooted in the use of renewable raw materials for producing biobased solvents, resins, additives, pigments, colorants, and crosslinkers. Lately, these bio-raw materials have tapped into the Renewable Carbon Initiative. Carbon dioxide that is released from a host of industrial and commercial processes is captured and used as feedstock for producing polymeric building blocks.

chnical successes but are presented and even marketed as niche products. Even today, 100% biobased coatings command only 1-3% of the global market volume. Market share rises to a generously estimated 10% if formulations that contain any amount of biobased raw ingredients are included, no matter how minuscule.

In order for biobased coatings to leap into a more mainstream view and command a larger market share, a number of hurdles still need to be overcome. The availability and price of biomaterials, as well as high technical requirements have had a limiting effect despite regulatory efforts to force the issue.

The fact is that the market for these coatings is still rather small, and production is more complex and more expensive than conventional products. Availability of renewable biomass materials would seem to be an easy challenge to overcome, but the fact remains that even renewable harvests take time to “grow” and can be thwarted by something as mutable as bad weather.

The industry is working on solutions that would be derived from biowaste, recycled content, and cellulose from carbon capture. But these solutions will take time to become practical realities.

The biobased coating market is still in its infancy primarily because the industry (which consists of individual companies trying to maximize market share and profitability) either cannot or is unwilling to invest heavily in biomass development for raw materials and in new manufacturing processes for those materials.

Research staffs across the industry have been slashed to the bare bones over the years. This leaves little time for the innovative, time-consuming, thoughtful development needed to ensure that biobased coatings and raw materials will ultimately achieve the same level of field performance and across-the-board acceptance as traditional products.

In short, the main challenges to large-scale acceptance of bio-coatings are consistent raw-material availability, affordable cost of manufacturing, comparable (or better) performance characteristics, and the time for scientists to innovate in this new dimension.

However, there are forces challenging the status quo within the coatings industry from other directions that have sparked a push to find new ways to address these dilemmas. Consumer awareness around “green” technologies is increasing, and customers are seemingly willing to reward companies that address those concerns by favoring their products.

Health problems emanating from well-publicized scandals such as excess formaldehyde in imported manufactured flooring and improperly constituted drywall that caused unexpected and enormous VOCs in the residential building industry further exacerbated the public’s growing demand for cleaner products.

Regulations are becoming more stringent around the entire paradigm of sustainability, driven in part by consumer demand and government initiatives. However, not all these challenges have resulted in punitive demoralizing actions or results.

Rather, paint companies have begun to approach the challenge differently by taking important smaller steps to develop crucial new molecules that act as “drop-ins” for segments of the paint recipe. This is especially important for balancing performance criteria and pricing competition with well-established petrochemicals.

Using drop-in building blocks provides a faster way to integrate biomass feedstock without the need to make large investments or drastically change high-capital investment production processes.

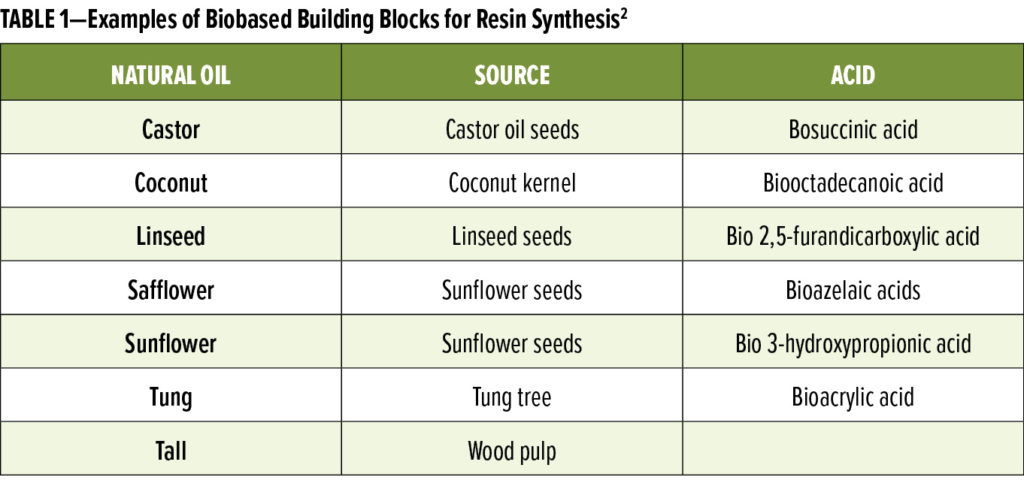

In addition, many of these monomers require UV light, oxygen, and renewable raw materials, providing more sustainable manufacturing and broader flexibility into a wide variety of markets. Examples of some of the more prominent biobased building blocks for resin synthesis are listed in Table 1.

In addition, many of these monomers require UV light, oxygen, and renewable raw materials, providing more sustainable manufacturing and broader flexibility into a wide variety of markets. Examples of some of the more prominent biobased building blocks for resin synthesis are listed in Table 1.

Polyesters are formed from the reaction product of polyols and a di- or multifunctional acid or carboxylic acid and anhydride for ester linkages in the polymer chain.

Solventborne alkyds have been used in coatings for decades. However, stricter pollution regulations have nudged the development of waterborne alkyds or polyurethane dispersions (PUDs).

PUDs offer improved performance over alkyds due to the robust urethane linkages. They are linear or lightly branched and of relatively high molecular weights dispersed in water. Lower film-forming temperatures at higher glass transition temperatures can be achieved because urethanes bond strongly to water.

Latex particles swell, causing a plasticizing effect. This allows PUDs to have lower VOCs and lower film-formation temperatures together with improved mechanical, chemical-, and corrosion-

resistance properties than waterborne alkyds or conventional latexes.

Some of the more recent biobased resin technologies are low-odor, low or no VOCs, and free from phenolethoxylates (APE). Performance characteristics seem to approach solventborne counterparts, although long-term durability testing is still ongoing. In any event, this is a positive step in manufacturing biobased coatings that does not compromise performance standards.