Introduction

The Global Market Analysis for the Paint and Coatings Industry (2019–2024)

In the first quarter of 2020, the sixth edition of the Global Market Analysis for the Paint and Coatings Industry (2019–2024) will be released by the American Coatings Association (ACA), on behalf of the World Coatings Council. Prepared by its international consultant, The ChemQuest Group, Inc., the report features extensive research findings and insights into current global and regional coatings consumption in 11 end-use segments, as well as trends and drivers influencing the market.

The report also provides a five-year forecast of the coatings market segments investigated. Insights contained in the report are based on a wide array of resources, including government economic data from numerous countries, major trade association statistics and reports, and in-depth interviews with coatings professionals including key coatings customers and end-users. The in-depth interviews enabled the authors to provide rich and unparalleled insights into trends, market drivers, unmet customer needs, technology challenges, key buying factors, market forecasts and other critical issues.

For the first time, the Global Market Analysis is being published in tandem with ACA’s U.S. Market Analysis to provide a fuller view of the domestic and international markets, the future direction of industry, technology and the competitive landscape. The new studies’ chapter formats correspond and are similarly scoped for ease of comparing United States and global market performance.

This article examines the coatings industry in the Asia Pacific (APAC) region—one of five regional segments detailed in the Global Market Analysis report.

Asia Pacific Region

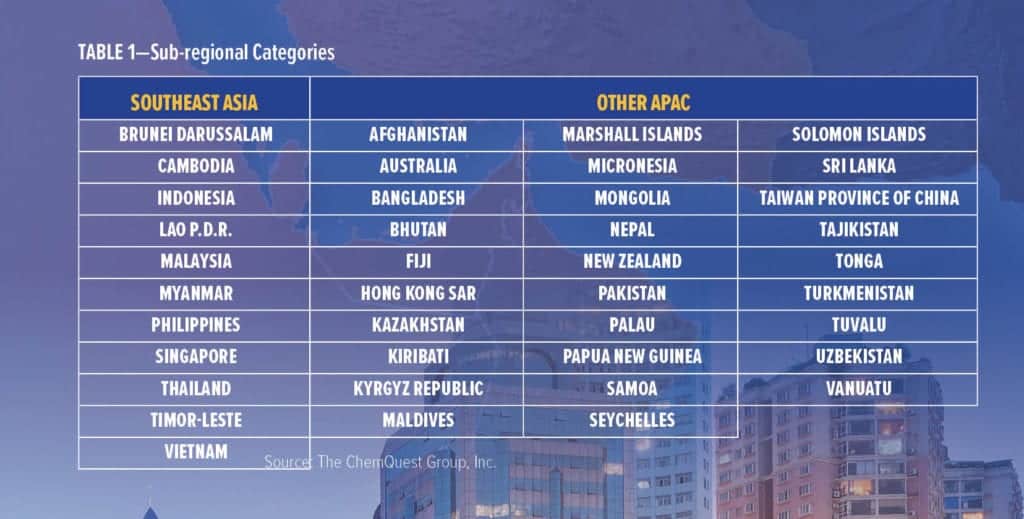

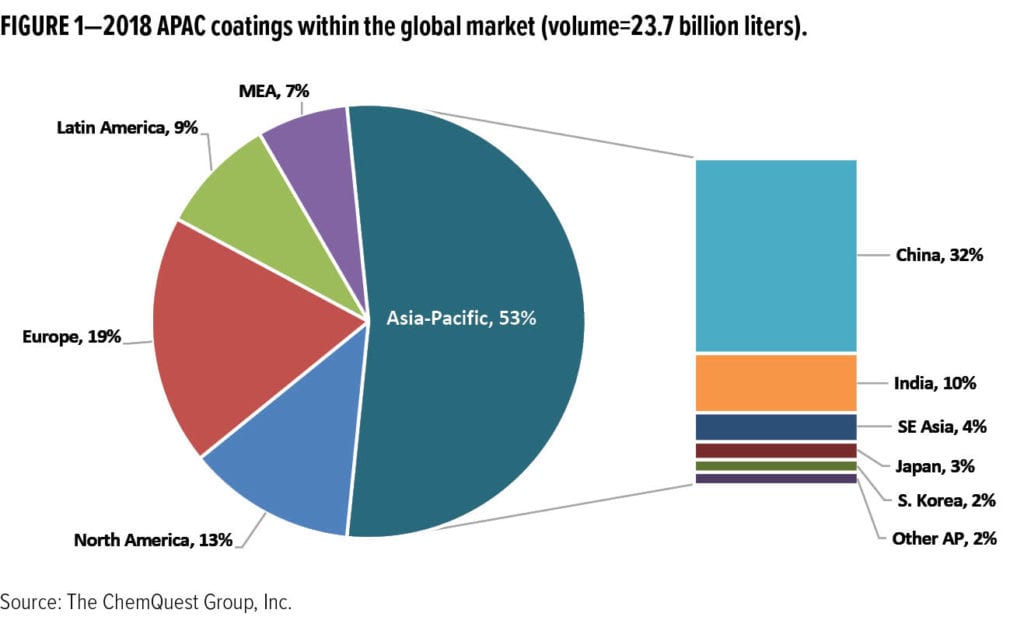

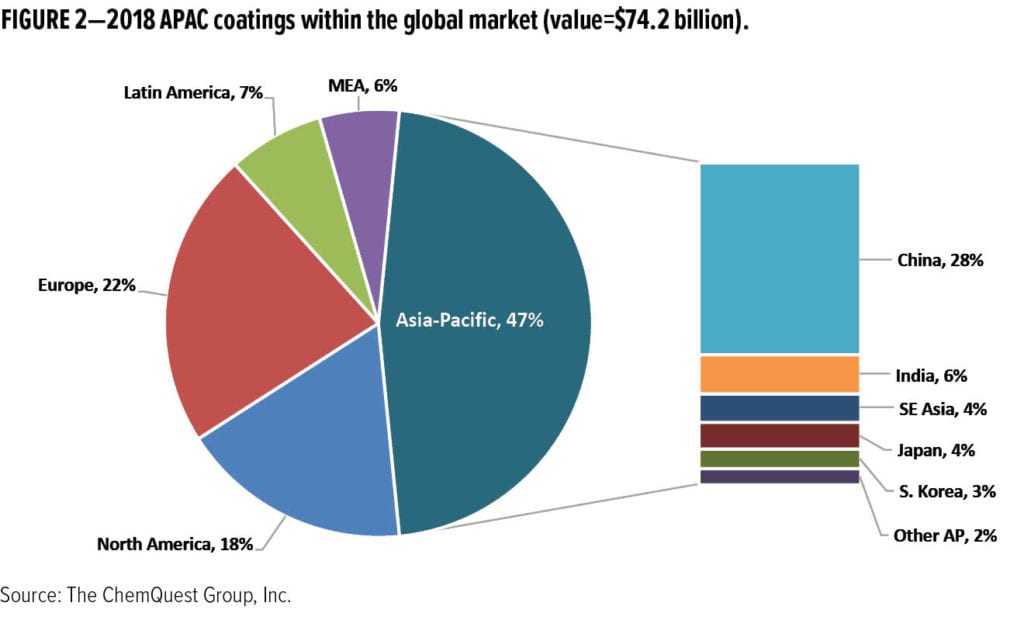

The APAC region consists of 50+ countries, the combined coatings production of which represents 53% of the volume and 47% of the value, of the global coatings industry. Unlike other major coatings-producing global regions, such as North America, Latin America or Europe, the APAC region is not homogeneous with regards to cultures, history, languages or economic development. Perhaps more to the point, the size, maturity, technology needs and growth rates of each country’s coatings market is quite different from others. Of the more than 50 countries in this region, four represent slightly greater than 87% of the entire region’s total coatings demand in both volume and value:

- China (59+% of regional volume; 60+% of regional value);

- India (18% of regional volume; 12% of regional value);

- Japan (6% of regional volume; 8% of regional value);

- South Korea (4% of regional volume; 6% of regional value).

China, with roughly 60% of the entire coatings volume of APAC, is clearly the most important coatings producer and user in the region, with India (18% of regional volume) a distant second, followed by a precipitous drop-off. Australia, despite its position as the fifth largest producer after South Korea is nonetheless extremely small, representing <0.5% of all volume and 2% of the value. It is, therefore, grouped with the nations under the category of “Other APAC” (see Table 1).

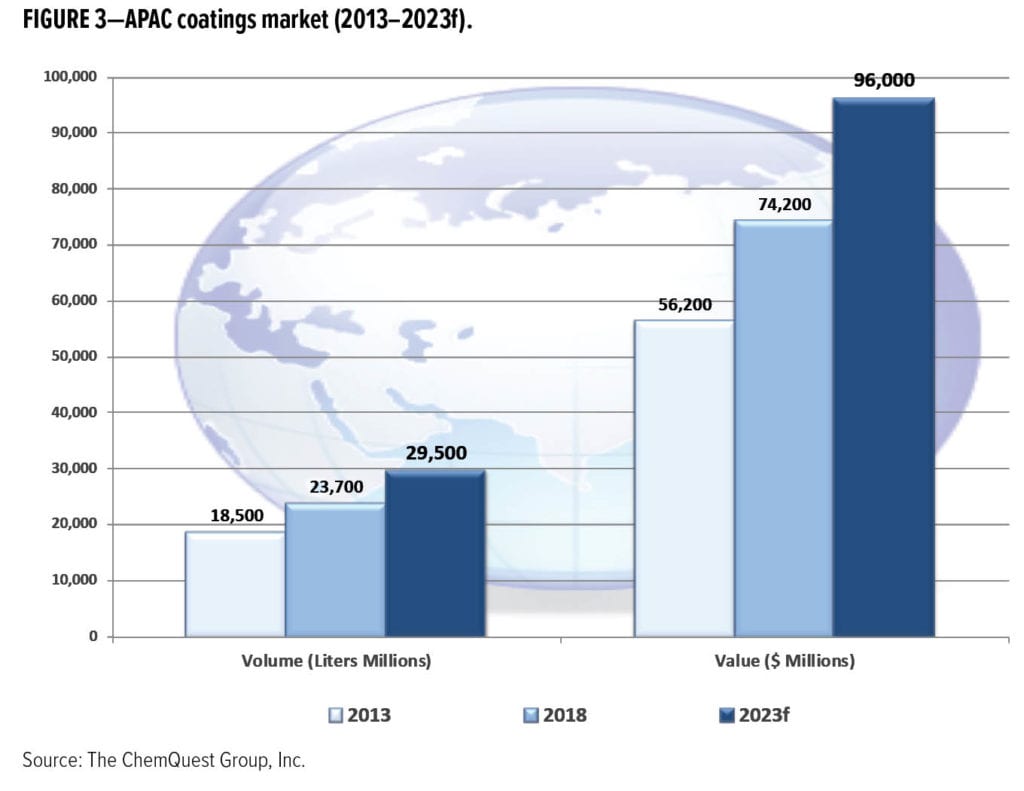

Unlike the North American and European global regions, value typically lags behind volume in APAC, although for Japan, South Korea and Australia, value generally outpaces volume, which should not be a surprise, given their status as developed countries. Between the years 2013–2018, paints and coatings revenues for APAC grew from $56.2 billion to $74.2 billion representing 18.5 billion liters and 23.7 billion liters, respectively (Figures 1 and 2).

Talk with practically anyone in the U.S. manufacturing industry about APAC, and the conversation will almost certainly devolve into a discussion about China, and the person to whom you are speaking is very likely to express something other than indifference or cool detachment about “China.” The subject of China tends to bring forth dynamic, often emotion-laden responses, in which it is seen as either a friend or foe, or—especially among the larger, more globalized corporations—as either a colleague or a competitor. For example, General Motor’s CEO Mary Barra correctly sees China as an exciting country in which to be producing cars and doing business—GM’s 27 plants, built to serve the Chinese market in the People’s Republic, produce and sell more cars than its 29 U.S. plants, and the profits that they generate come from Chinese sales and are used to run the Chinese plants. U.S. profits are not involved in GM’s Chinese business, nor have any U.S. plants been “moved to China.” Although 30,000 Buick Envisions were built in China and sold in the United States in 2018, this is such a small number (roughly 1% of GM’s total sales in the United States) that its impact on GM’s manufacturing business in the United States is negligible.1 On the other hand, a U.S. firm manufacturing and selling textiles, plastics or paper products sees not so much an opportunity for expanding production into an indigenous Chinese market, as GM has, but rather a type of terrestrial “black hole” sucking business out of the United States and into China, with only minimal hope of ever reclaiming the lost production. Just as beauty is in the eye of the beholder, so too is the judgment of “goodness” or “badness” of Chinese manufacturing activity.

Most readers of this article, however, are neither building cars nor weaving textiles—they are making, purchasing or providing raw materials for paints and coatings. For better or worse, how do we perceive China as we contemplate the future of our individual subsegments of the U.S. paints and coatings industry?

Again, everything is relative to circumstances—to time, place, economic conditions, cost of labor, cost of energy, availability of cargo shipping capacity and a host of other factors. One principal truism, however, is that the U.S. paint and coatings industry is not generally vulnerable to imports of paints and coatings, due to the products’ shipping weight and the associated transportation costs. Very little paint is actually shipped into the United States, nor would we expect it to be—<4% of the value of the total U.S. paint industry, based upon first sale, is imported, and roughly 45% of that is from within North America.2

The same is true of paint being exported by the United States—there is not very much of it (~9.3% of total value, 70% of which is shipped within North America) primarily because the cost of transportation is simply too high. In general, this is a scenario that is repeated on a global basis, even in Europe, where distances among countries, per se, present few barriers to commerce of paints and coatings. The majority of the first- and second-world countries have their own paints and coatings industry, and that industry’s production is typically used primarily within the country. Paint, therefore, is not typically exported from China. It is not uncommon, however, for consumer and durable goods to be either manufactured in China, painted in China and then exported to other parts of the world, or for articles or parts of articles, such as furniture components, to be shipped to China, painted, and returned to the country of origin. Cost of energy is cutting into this, but it has had quite an impact on certain U.S. end-markets, such as fine furniture, beginning in the early 1990s. (Ironically, some of this business has now moved from China to other countries within APAC because they have now become lower-cost producing areas.)

For these reasons, the Chinese paints and coatings industry is most clearly observed, and most accurately and objectively portrayed if we study only the industry itself which is comprised of ~10,000 coatings manufacturers, concentrated in eastern, central and southern China, rather than concentrating on the wood, plastic, metal, and composite articles that Chinese industry paints and exports.

Of China’s 10,000 or so coatings producers, the top 100 account for ~50% of the volume, of which roughly 70% is OEM. (The top 1,000 producers account for ~80% of all coatings produced.) China has ~4,000 powder coatings producers, with small enterprises producing less than 1,000 kilograms/annum. Clearly, consolidation (which is already underway among the multinational and joint venture producers) will need to escalate, abetted by rising raw material costs and increasing regulatory requirements.

China’s overall portion of both value and volume for APAC centers on 60%, and its 2018 revenue constituted ~$44.5 billion of APAC’s total sales of $74.2 billion on sales of roughly 14.2 out of APAC’s 23.7 billion liters (Figure 3).

Looking at these numbers on a global scale, this means that China’s $44.5 billion represents approximately 28% of the global paints and coatings industry’s $158 billion value, and its 14.4 billion liters represent 32% of global volume of 45 million liters; so whether in the context of APAC or in the context of the global coatings industry, China certainly stands out as a major coatings-producing nation.

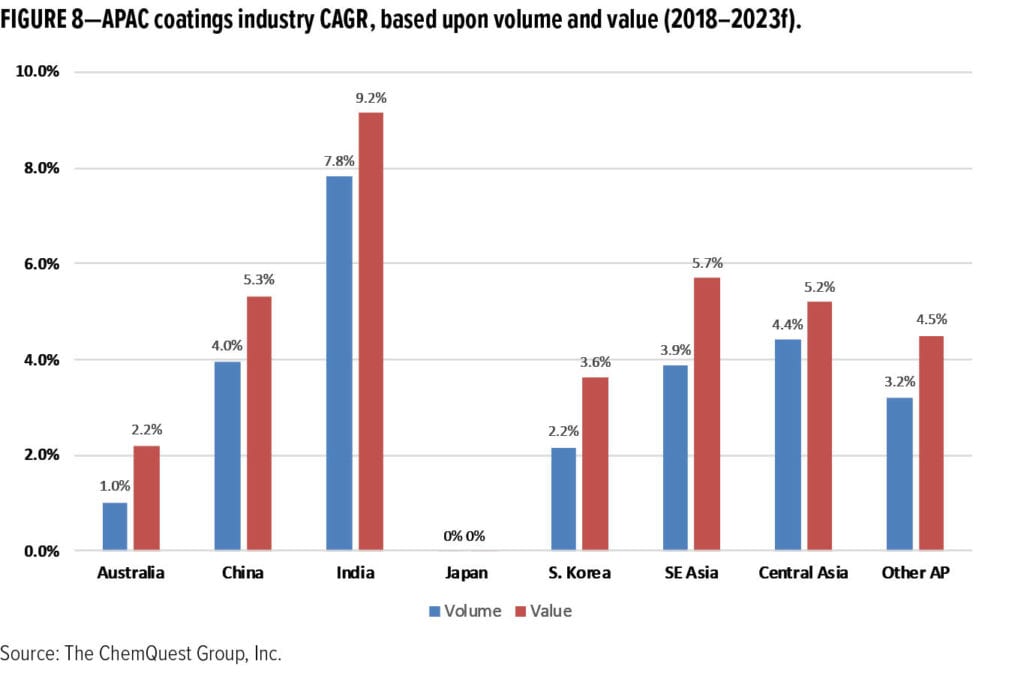

All this said, however, China is not synonymous with APAC, despite the size of its paints and coatings industry. It is easy, but neither wise nor appropriate, to overlook the fact that 40% of coatings produced in APAC do not emanate from China, and comprise a very significant volume of 9.5 billion liters valued at nearly $30 billion. The CAGR for the entire APAC region (2013–2018) was 5.1% (volume) and 5.7% (value), and projected growth for the period 2018–2023f is 4.4% (volume) and 5.3% (value). This suggests that value is slowly catching up to volume growth in the region’s under-developed countries.

Market Dynamics

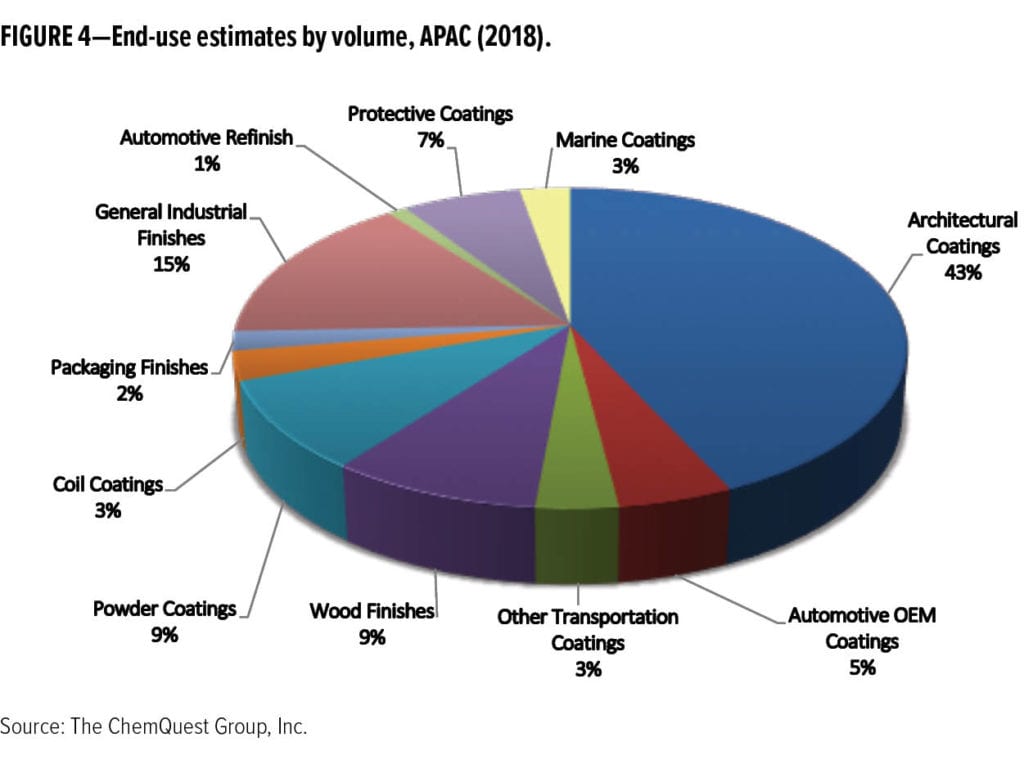

In APAC, the largest slice of the coatings production pie is architectural coatings, which represents 43% of total volume in the region. This makes sense, because this is a relatively underdeveloped area of the world with a significantly expanding middle class that is seeking to improve the design and appearance of their homes. Architectural paint is a relatively low-cost means for adding interest value to both the interior and exterior of their homes, whether individual houses or multifamily dwellings. The architectural segment is followed by general industrial finishes, at 15% of volume, and then by nine other, much smaller, segments that parallel similar classification in other regions of the world (see Figure 4).

APAC is part of the global economy, and even though the paint and coatings industry still has many regional and local elements in its makeup, it is strongly impacted by global economic conditions, because there is a strong correlation between GDP per capita and paint and coatings consumption per capita. Just as the global paints and coatings industry was deeply affected by the Great Recession of 2008–09, which was ultimately caused by chaos in the U.S. mortgage market, so too can it be affected by other economic situations, occasionally predictable but typically unexpected, that might arise elsewhere within the global business community.

For the past five years, advanced economies (United States, Euro Area, Japan, United Kingdom), have experienced a continued recovery from the Great Recession, and GDP for these countries was projected to grow during 2019, albeit at lower rates than in 2018:

- U.S. forecast: +2.6%, down from 2.9% in 2018;

- Europe and Central Asia forecast: +1.6%, down from 3.1% in 2018;

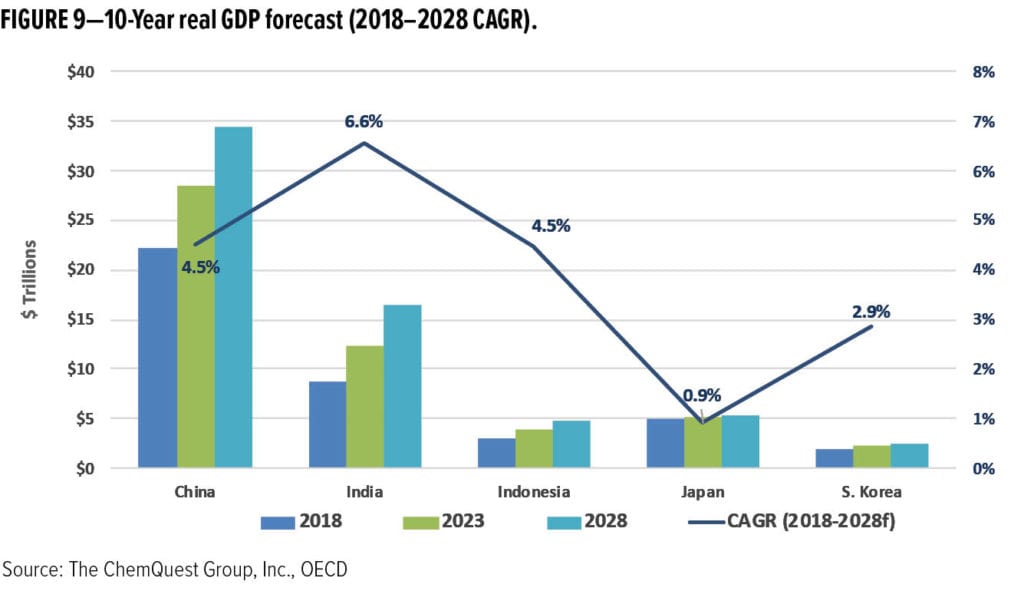

- China forecast: +6.2%, down from 6.6% in 2018.

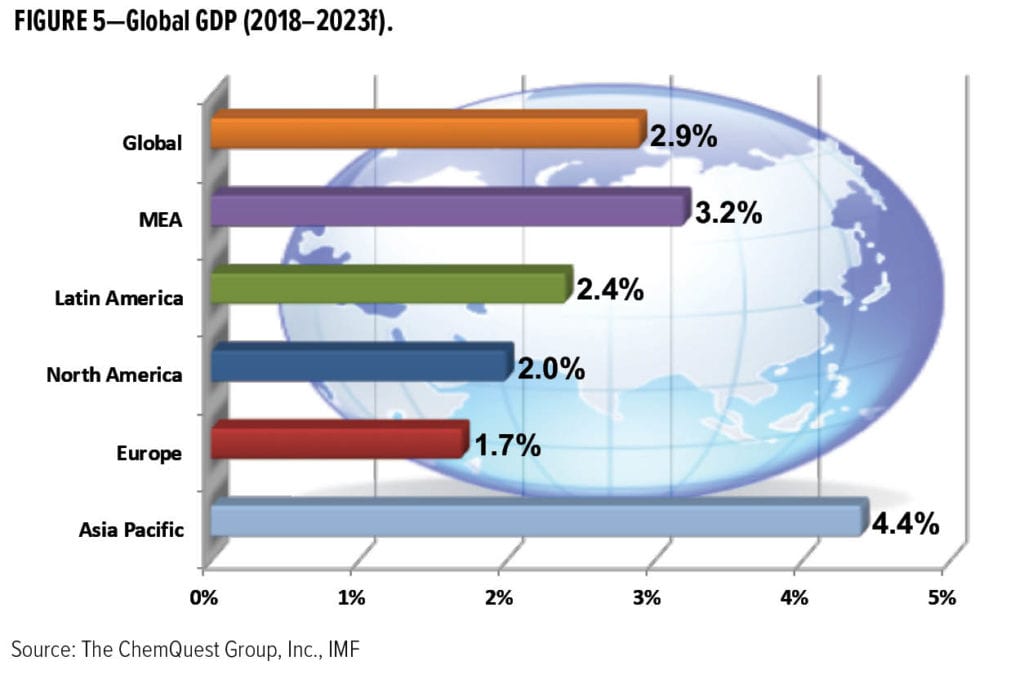

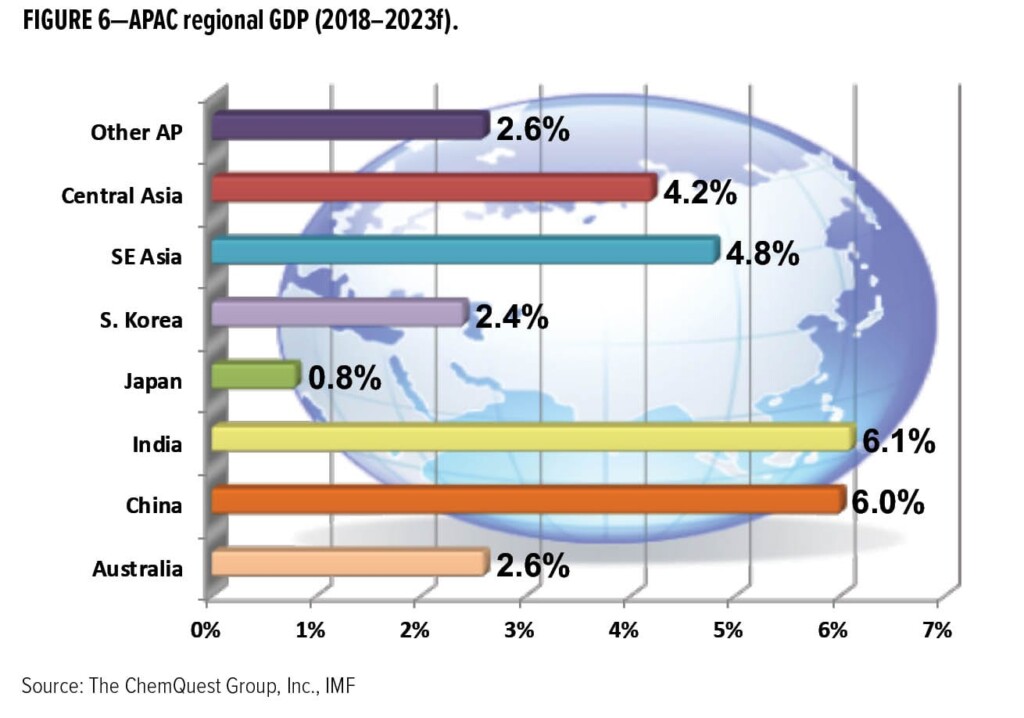

Between 2018–2023, China’s paint and coatings production, with a CAGR of 4.0% (volume) and 5.3% (value), is expected to grow at a very slightly slower rate than APAC as a whole, which is 4.4%/year (volume) and 5.3%/year (value). China’s coatings sector is also growing more slowly than GDP expectations for this region (see Figures 5 and 6).

Market Trends and Drivers

Overall regional sales are strongly influenced by government subsidies, construction activity, automotive production, general industrial production, interest rates and consumer spending, all of which are important components of GDP—and coatings demand in APAC tends to follow GDP growth, perhaps even more closely than in the other global regions. With the largest agricultural and construction markets in APAC, China is particularly vulnerable to these market forces. Faced, for example, with declining car sales (expected to be down 12% in 2019 from 2018), China is making financing more accessible to boost sales, but Chinese consumers still rely less on financing than developed markets (30–40% China vs ~70% others, on average). China’s slowing economy, coupled with rising home prices, is also likely to lower demand for architectural coatings. In response, China is reducing its focus on manufacturing to drive the transition to a service-driven economy. This will take many years, of course, and because APAC (notably China) is a manufacturing leader across many sectors, including auto, appliances, trucks, bikes, brown goods, electronics and rail, the overall effect will not be a sudden or jolting one.

As manufacturing in China undergoes a slight decline, it will be picked up by other nations within APAC, where changing demographics are positive for coatings growth—growing middle classes are creating demand for greater use of coatings, and also requiring that the coatings be both higher quality and be based upon higher-performing technology. Rapid urbanization and more stable economies throughout APAC are stimulating the increase in home supply stores, particularly in Indonesia. However, the DIY market is small in many APAC countries, notably China and India, because labor to apply paint is both readily available and relatively inexpensive. In contrast, Japan has labor shortages due to its aging population, and is, therefore, more focused on productivity and efficiency gains to help sustain its coatings industry.

APAC has maintained its global coatings leadership position for two important reasons:

- It is a leading manufacturer of coated goods for countries throughout the world, particularly the United States and western Europe;

- It is responding to increased domestic consumption as its component countries raise their standards of living.

For many products, end-use trade patterns have the most influence on the coatings market. In general, coatings tend to be manufactured and applied in the region in which the end-use product is fabricated, with the exception of architectural and auto refinishing coatings, which are consumed in the same region where they are produced. Tariffs and trade agreements are impacting some trade patterns, and EU’s antidumping policies have reduced its volume of Chinese-coated imports. The 2019 EU-Japan trade deal will result in fewer Japanese car exports to EU over the coming 10 years, and escalating trade tensions between the United States and China have had negative repercussions throughout the world. Vietnam has been the largest beneficiary of diverted trade, followed by Taiwan, Chile, Malaysia, Argentina, Brazil, Singapore, South Korea, Hong Kong, France, Mexico and Canada. China’s direct investments have boosted other economies, most notably in Latin America.

Technology Overview in APAC

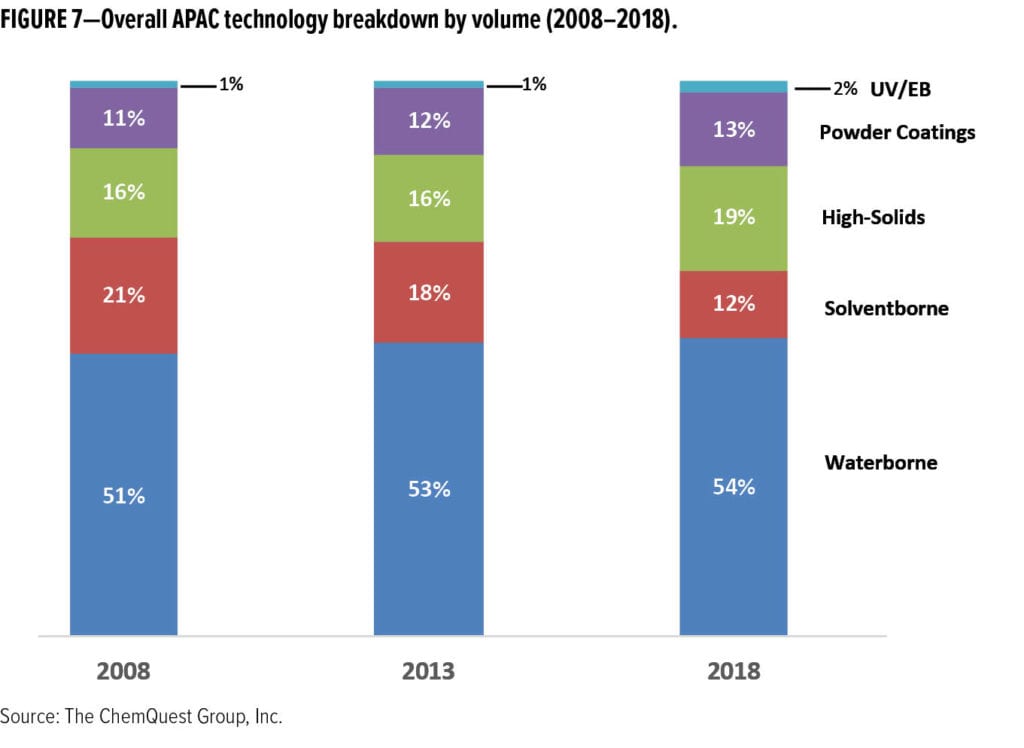

Although choice of polymer technology varies by end-use market segment and—at least to a certain extent—the country in which the coatings are to be used, it is clear that APAC, overall, is shifting away from conventional solventborne coatings to high solids, waterborne, powder coatings and energy-cure systems. There are many reasons for this, but a tightening regulatory environment, especially in China, and technology advances that enable the production of “greener” products are certainly among the most important drivers, and it may be because of their “green” components that China is the largest global producer of alkyd paints and coatings. The use of powder coatings (no VOCs or HAPs) in many countries in APAC has been in place, especially in China, for more than two decades, and has been used for many product parts in general industrial, appliance, fusion-bonded epoxy for pipelines, extruded aluminum for building construction and automotive underhood parts. We anticipate that the next major end-use for which China is expected to switch to powder coatings will be sheet parts for construction machinery.

According to industry estimates, over 50 UV-cure coatings manufacturers —including Changrunfa (one of the largest), Huilong Paint and Carpoly—are based in China. UV-cure coatings are predominantly used for wood and plastic coatings end-uses, although Shanghai PhiChem Material Co., Ltd., is the third largest global supplier for UV-curable coatings used on optical fiber that must meet the stringent requirements for mechanical microbending and optical refractive index characteristics for optical fiber coatings (see Figure 7).

Environmental regulations are expected to become more stringent throughout APAC, due to rising environmental awareness, particularly in China where, contrary to many commentators’ opinions, the government is profoundly serious with regards to providing a cleaner environment for its citizens. China’s environmental regulations and compliance requirements are becoming stricter to combat air quality issues, resulting in a changing coating supplier base, as manufacturers decide whether to move plants or simply close them. Government quotas require carmakers to sell a certain percentage of hybrid and all-electric vehicles or face fines. Formaldehyde content is another area of significant concern for Chinese regulators, who are concerned about studies that have conclusively shown that formaldehyde levels in certain housing components significantly exceed national standards, which are comparative with similar standards in other global regions.

While the Chinese government is not always favorable to accepting requests and/or suggestions for change from other governments around the globe, it must change hats as a major exporter, and pay close attention to global market trends and requirements, including sustainability trends from coatings end-users. Such trends are influencing product designs and buying trends on a global basis, which, in turn, impact global and APAC changes in coating preferences, technology development, and potentially even volume demand. Consumer focus (especially by Asian millennials) is on product quality, less packaging, minimalism benefits, etc. Digitalization, as more of the world goes “online,” is bringing awareness of social concerns (climate change; global “throw away” culture; the effects of nonbiodegradable plastics on the environment; demands for more energy-efficient/lower carbon footprints for public transit systems; electric vehicles; “green buildings” and a host of other topics not always welcomed by authorities) and potential innovative solutions while helping China to expand its access to global markets.

As the middle class grows and becomes more consolidated in various APAC countries, per capita usage of paint is going to increase substantially, and outstrip many other elements of GDP. Looking ahead with respect to APAC’s paint and coatings industry, we expect to see this industry outperform GDP, despite the established relationship that it has with GDP in the developed countries of the world (see Figures 8 and 9).

By 2023, we forecast paint demand in APAC at 29.5 billion liters valued at $100 billion. APAC will continue to produce and use more solventborne coatings than North America or Europe, but it will be steadily switching these systems to “compliant,” “sustainable,” and “green” systems. This will occur despite the trend in China to move from a manufacturing- driven to a service-driven economy, because many other countries in APAC are still in a growing manufacturing mode and are beginning to compete with China as manufacturing hubs—and because, even as its coatings manufacturing sector becomes more mature, the sheer size of that sector will remain a major factor in the global paint and coatings market. Finally, it must always be kept in mind that, in most countries within APAC, per capita demand for paints and coatings still has significant room for growth—even China, with a per capita demand of 10.2 liters/person is well short of South Korea’s per capita demand of 19 liters/person, and overall APAC is running at only 5.9 liters/person; so significant expansion in the production of paints and coatings in the future is an extremely safe bet.

APAC is a dynamic, strong and formidable factor in the global coatings community—geography, demographics, economic factors and the opportunity for considerable consolidation all work together to assure it remains so for both the near- and long-term future.

World Coatings Council’s Global Market Analysis (2019–2024)

Market Chapters

Architectural Coatings

Automotive OEM Coatings

Coil Coatings

Powder Coatings

General Industrial Finishes

Packaging Finishes

Other Transporation Coatings

Wood Finishes

Automotive Refinish Paint

Marine Coatings

Protective Coatings

Regional Chapters

North America

Europe

Asia Pacific (APAC)

Latin America

Middle East and Africa (MEA)

Bonus Chapters

Raw Material Feedstocks:

Dynamics & Trends

Global Mergers & Acquisitions

(2017–2019)

ABRAFATI – Brazilian Paint Manufacturers Association

ACA – American Coatings Association (Secretariat)

ANAFAPYT – Mexican Paint and Printing Ink Manufacturers Association

APMF – Australian Paint Manufacturers’ Federation

BCF – British Coatings Federation

BOSAD – The Turkish Paint Manufacturers Association

CEPE – European Council of the Paint, Printing Ink and Artists’ Colours Industry

CNCIA – China National Coatings Industry Association

CPCA – Canadian Paint and Coatings Association

FIPEC – French Paints, Printing Inks, Artist Colours and Adhesives Association

IPA – Indian Paint Association

JPMA – Japan Paint Manufacturers Association

NZPMA – New Zealand Paint Manufacturers Association

SAPMA – South Africa Paint Manufacturers Association

VdL – German Paint and Printing Ink Industry Association

CoatingsTech | Vol. 17, No. 2 | February 2020