Highlights from IPPIC’s Global Market Analysis for the Paint & Coatings Industry (2015–2020)

By Aggie Lotz, The ChemQuest Group, Inc.

In May 2017, the fifth edition of the Global Market Analysis for the Paint & Coatings Industry (2015–2020) was released by the International Paint and Printing Ink Council (IPPIC). Prepared by its international consultant, the ChemQuest Group, Inc., the report features extensive research findings and insights into global and regional coatings in 11 end-use segments as well as sub-segments. This article provides an overview of intumescent coatings, an important sub-segment of industrial maintenance coatings that is contained in the report.

Industrial Maintenance and Protective Coatings

Industrial maintenance and protective coatings are formulated to provide protection for exterior and interior substrates against corrosion, abrasion, thermal, and chemical and ultraviolet (UV) degradation in both industrial and critical service environments. These coating systems, as the name indicates, are used primarily in industrial segments where aggressive corrosive or chemical environments exist, in addition to commercial applications where long-term protection and aesthetics are required. While such coatings are primarily considered functional, appearance and retention of these coating systems have also become important performance requirements.

Industrial maintenance and protective coatings are combinations of products designed to perform and protect under specific conditions. Such coatings systems are usually applied by specially trained, professional applicators in a fabrication facility or in the field. They can be applied as part of new construction, or during routine maintenance to provide continued asset protection from various forms of structural deterioration.

Industrial Maintenance Coatings Types

Dominating the industrial maintenance coatings segment is solventborne coatings—including both conventional and high-solids products—accounting for approximately 65% of 2015 total volume. The majority of industrial maintenance solventborne coatings are high-solids products, as the industry strives to meet ever-tightening environmental regulations without sacrificing product performance. Included in the high-solids category is 100% solids technology that plays a key role in severe service applications. It is used extensively in tank linings, deck coatings, and secondary containment. They are mostly epoxy, novolac, and even aromatic polyurethane when impact resistance is required to improve wear. The trend toward high-solids coatings is expected to continue.

Emerging Technology and Trends

One example of an end market pushing the performance envelope for conventional coatings is the oil and gas industry. A current trend is toward higher pipeline operating temperatures to increase transportation volumes. Therefore, a common characteristic is the elevated temperature of the oil (up to 150°C and potentially even higher). This directly impacts pipeline coating performance that can degrade at elevated temperatures, resulting in internal and external corrosion problems affecting such flowline systems.

In the past 10 years, one solution to mitigate external pipeline corrosion has been the use of epoxy/phenolic resin-based coatings; these perform reliably up to 120°C. High-temperature, epoxy/novolac matrices can handle constant or repeated temperatures up to 177°C in dry conditions and 149°C in the wet, but they require a thermal cure—not practical for many field applications.

Nanotechnology refers to materials with dimensions in the 1–100 nanometer range, where quantum mechanics yield interesting properties. Nanostructured materials yield extraordinary differences in rates and control of chemical reactions, electrical conductivity, magnetic properties, thermal conductivity, strength, and fire-retardant properties.

Intumescent Coatings

One type of functional coating is a fire-retardant variety (also known as an intumescent coating) to insulate steel substrates exposed to fire. The fire-retardancy property is project-dependent but generally understood to mean a coating can withstand temperatures in the range of 200°C to 600°C for a period of time.

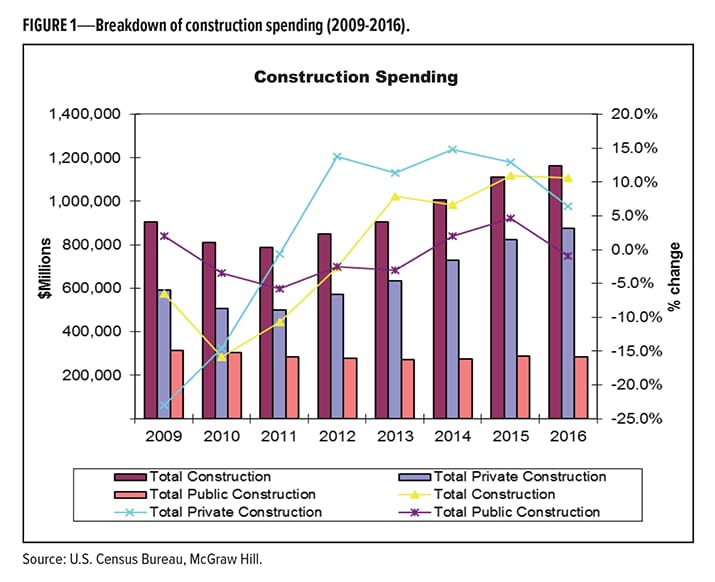

The demand for intumescent coatings is closely tied to construction spending. The split between U.S. residential and nonresidential construction is 60/40. Nonresidential construction spending continues to increase (4.1% in 2016). Construction markets showing double-digit, year-over-year growth include lodging, office, and commercial structures. Public construction, in areas such as water supply, sewage treatment, and public safety, was down slightly in 2016, but the short-term outlook is positive, depending on U.S. infrastructure spending. Overall, the average growth in total construction spending has been a robust 8.1% over the last five years. Figure 1 contrasts public and private construction growth for the United States in value (2009–2016).

There is demand for intumescent coatings in specialty coatings sub-segments, such as marine, transportation, onshore/offshore oil and gas production, and new industrial and commercial construction. The increased use of lightweight materials for transportation, modular homes, and insulation applications is a key driver. Intumescent paints are increasingly used to protect spherical structures containing natural gas, peroxides, and other chemicals.

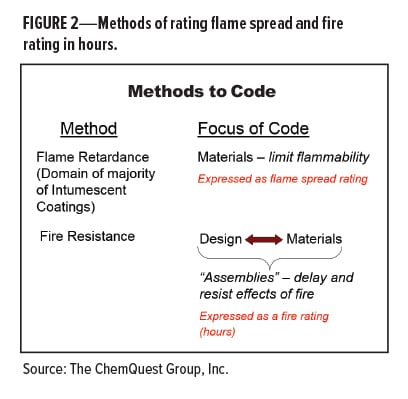

Of special importance in new construction of commercial buildings, intumescent coatings incorporate flame-retardant chemicals to achieve two distinct industry efficacy ratings. The first measures flame spread, or how effectively the coating limits flammability (according to ASTM E84). The second rating demonstrates coating efficacy for delaying and resisting the effects of fire (expressed in hours), as shown in Figure 2.

Industry definitions may aid in a better understanding of what an intumescent coating (also known as fireproofing) is and is not. According to SSPC’s 2011 Protective Coatings Glossary, a fire-retardant is a

“ . . . product, under accepted methods of test, that will significantly: (1) reduce the rate of flame spread on the surface of a material to which it has been applied, or (2) resist ignition when exposed to high temperatures, or (3) insulate a substrate to which it has been applied and prolong the time required to reach its ignition, melting, or structural-weakening temperature” [ASTM D 16]. Flammability is defined as the ability to catch fire (a flammable material burns quickly and easily). Inflammability can sometimes mean “not flammable.” SSPC has separate definitions for a flammable aerosol, gas, liquid, and solid material, based on their respective properties to ignite and burn, according to various test methods. Moreover, an intumescent coating, according to SSPC’s definition, is “a fire-retardant coating that when heated forms a foam produced by nonflammable gases, such as carbon dioxide and ammonia. This [reaction] results in a thick, highly insulating layer of carbon (about 50 times as thick as the original coating) that serves to protect the coated substrate from fire. See also FIRE-RETARDANT [ASTM D 16].”

By comparison, heat resistance is defined by SSPC as “the ability of a coating to resist deterioration when exposed continuously or periodically to high temperatures at or below a given level. Heat resistance depends on the binder type and other coating ingredients.”

In summary, a heat-resistant coating and an intumescent coating have different properties and chemistries; therefore, the terminology should not be used interchangeably. The difference between the two types of coatings is that an intumescent coating insulates the substrate from fire, i.e., protecting it against heat transfer. However, a heat-resistant coating will—by some measure—resist degradation from heat, yet it does not insulate or protect the substrate from heat. Consider, for illustrative purposes, the coating on grills: the coating itself will not degrade but the metal becomes very hot when in use.

Protective coatings with heat-resistant properties are used in light- and medium-duty industrial maintenance applications, such as production equipment refurbishing. Flame-retardant coatings are typically used for decks, walls, rails, and load-

bearing steel beams and support columns. High-heat and/or flame resistance is also important in heavy-duty maintenance coating applications for refineries and furnaces, jet engine components, and transportation engine parts—such as exhaust manifolds and gaskets. Their selection is not solely driven by a specific need for thermal protection, but also by new and existing fire codes/regulations promulgated following 9/11. ASTM D2485-91(2013), Standard Test Methods for Evaluating Coatings for High Temperature Service, is a test method that provides an accelerated means of determining acceptable performance of coating systems developed to cover steel that may be potentially exposed to high temperatures during its interior and exterior service life.

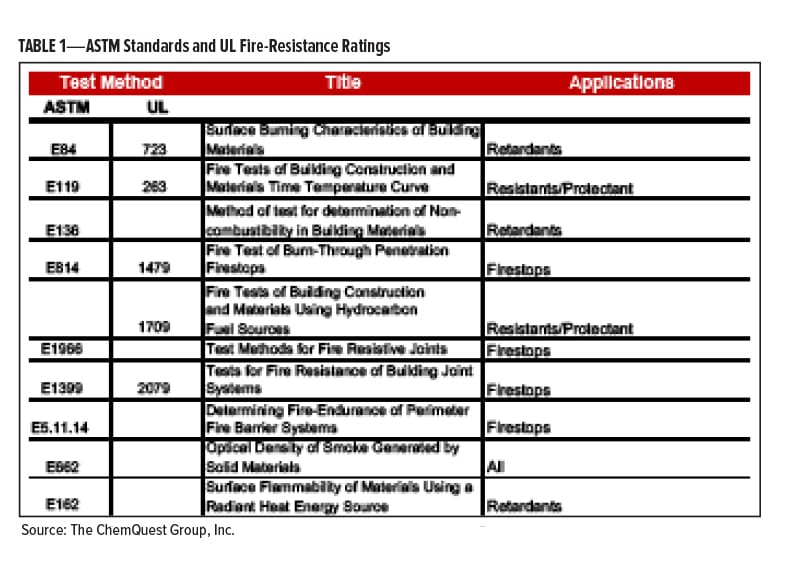

Other examples of ASTM test methods and UL codes for fire protection coatings in commercial and industrial construction are noted in Table 1.

In new construction applications in the oil and gas industry, a “massive change” moving toward OEM fireproofing was a trend noted in 2015; whereas fireproofing in maintenance and repair applications, by comparison, could be cost prohibitive. In older plants, installing intumescent coatings sometimes requires removing cementitious structures (otherwise “hidden” corrosion behind the concrete—left untreated—can put the cementitious structure at high risk of collapsing). Concrete removal is where the high cost emerges.

Typically, intumescent coatings technology includes vinyl toluene acrylics, styrene acrylics, silicone acrylics, fluoropolymer, epoxies, urethanes, and chlorinated rubber. For cellulosics, intumescent coatings can be either solvent- or waterborne, with the latter generally based on vinyl acetate or acrylic. In contrast, those used against hydrocarbon fires are all epoxies. Thin film is typically used in general construction including structural steel, while the thick-film coatings tend to find use in the oil and gas industry, such as for protecting petroleum refineries. Depending on the application, an array of low-VOC, (often) thick-film chemistries can be used to achieve specified requirements—such as the ability to adhere to urethane foam.

Major manufacturers of intumescent coatings and fireproofing products include Carboline, StanChem, Flame Control, Isolatek, Flame Master, Benjamin Moore, Sherwin-Williams, PPG, AkzoNobel, Jotun, and many others. Due to the critical properties that fireproofing imparts to steel structures, the proper application of intumescent coatings is essential to ensure public safety. SSPC’s Train the Painter (TTP) is addressing the need for industry training and qualification criteria through its two-part Coating Applicator Specialist training module for Intumescent Coatings: section 2.1 is for Thin-Film; section 2.2 is for Thick-Film.

Top-line growth opportunities for intumescent coatings may include properties such as low smoke generation, combustion prevention, and a polymer for formulating thinner films to improve aesthetics on steel surfaces. Eliminating the need for a topcoat over the intumescent product may also be desired in some exterior applications.

The International Paint and Printing Ink Council’s (IPPIC) expanded fifth edition of the Global Market Analysis for the Paint & Coatings Industry (2015-2020) provides comprehensive market research covering the global paint and coatings industry, addressing topics of relevance to coatings manufacturers, end users, raw materials suppliers, private equity firms, and others interested in the industry.

Prepared by The ChemQuest Group, Inc., IPPIC’s international consultant to the specialty chemicals and coatings industries, the report covers three primary categories of coatings: Decorative, Original Equipment Manufacturers, and Special Purpose, as well as the many sub-segments within those categories. Chapters focus on sector analysis, market trends and drivers, and competitive landscape.

The fifth edition of IPPIC’s Global Market Analysis was expanded to include new features such as additional forecast data, an expanded raw material chapter, as well as a new chapter on mergers and acquisitions. Additionally, the fifth edition is far more comprehensive in scope to include—as is the subject of this article—an overview of intumescent coatings as a growing sub-segment of industrial maintenance and protective coatings.

For more information on the content of IPPIC’s Global Market Analysis for the Paint & Coatings Industry (2015–2020) and to purchase the digital download, visit paint.org (Publications & Resources online store) or contact Steve Sides at ssides@paint.org (202.462.6272 x225).

CoatingsTech | Vol. 15, No. 1 | January 2018