By Cynthia Challener, CoatingsTech Contributing Writer

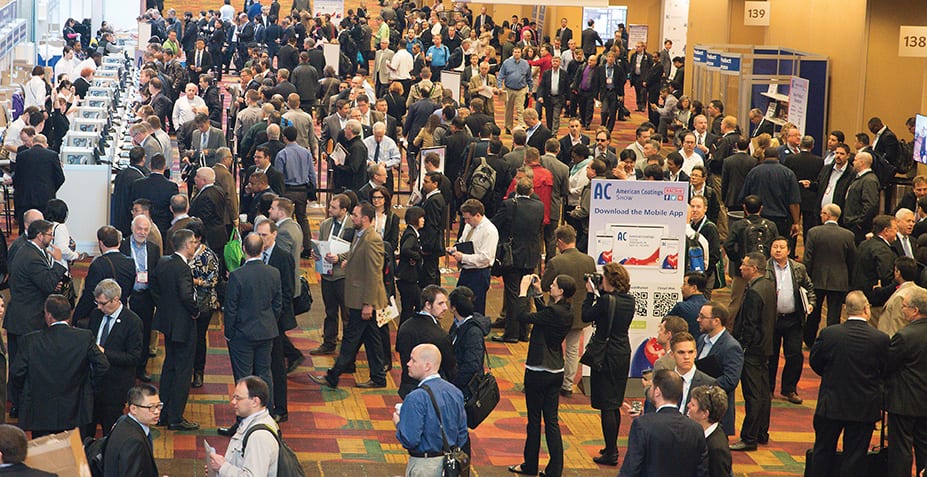

The much-anticipated American Coatings SHOW (ACS) and CONFERENCE (ACC) will be returning to the Indiana Convention Center in Indianapolis, Indiana on April 9–12. Hosted by the American Coatings Association in collaboration with Vincentz Network, the ACS has increased significantly over the five biennial events held to date—with exhibitor and attendee numbers rising from 331 and 5,600 in 2008 to 559 and 9,100 in 2016, respectively. Given the state of global economies and the strong growth occurring in the coatings market, those numbers are expected to be even higher this year. Anticipated hot topics include the impact of merger and acquisition (M&A) activity; sustainability, which includes ensuring high performance while reducing environment impact; multifunctionality; and, of course, cost-effective solutions to coating formulation challenges.

Lots of Excitement

Based on the overall positive performance of the global economy and financial markets, and despite recent U.S. stock market fluctuations, Huber Engineered Materials expects ACS to set record attendance levels in 2018, according to marketing communications manager Keith Sorrell. “For the first time in a number of years, global markets are synchronized and performing well. Without question, both the major players and smaller companies will be exhibiting and attending, including more international participants than in previous years,” he says. King Industries also expects to see record numbers in attendance at the show, which marketing communications manager Karen Grunwald hopes the company can leverage for the creation of new customers and opportunities. The ACS has become even more popular since its move to Indianapolis, adds Harley McNair, owner of Pflaumer Brothers. “This location allows greater numbers of technical people to visit from coatings industry centers such as Chicago, Cleveland, Pittsburgh, and other parts of the country,” he explains.

Expectations are also high with respect to the potential to learn about the industry at ACS 2018. With an industry as dynamic and fluid as the coatings sector, there is always something new to learn on the technology side, according to Matthew Hayden, applications manager for Polynt-Reichhold. “The acceleration of technology has continued to impact the show over the last decade,” agrees Jonathan Bird, North America marketing manager for Lubrizol Performance Coatings. “This technology shows up in the products, presentations, and booth displays themselves, and the differences influence how coatings formulators interact with suppliers and learn about their products,” he observes. This year’s ACS CONFERENCE theme, “Building a Lasting Future: Innovation for the World,” reflects the constant innovation in the industry, according to Steve Willoughby, market manager with Eastman. In fact, he believes 2018 will be a banner year for innovation.

Because the ACS is only held every two years, Jay Janis, director of Strategic Account Management with Evonik’s North American Paint and Coatings Industry Team points out that there are always many changes in the industry in the interim. “Organizations, people, products, and technologies are all dynamic, and the ACS provides an opportunity to not only get fully up-to-date, but also look to the future,” he comments. Increased requirements outlined under TSCA, REACH, and other regulations have changed the landscape of the coatings industry as well, according to John Hurban, Michelman’s vice president and managing director for the Americas. “Members of the coatings industry have an interesting road ahead because manufacturers want coating products to be globally available while also addressing each region’s specific market needs,” he notes.

Companies across the supply chain are also consolidating to increase their global footprints, meet customer demands, satisfy those changing regulatory requirements, and pursue the future of sustainable coatings, according to Kate Glasser, North America business director with Dow Coating Materials (DCM). “Mergers and acquisitions are occurring on a more regular basis, and we expect this industry consolidation will be a topic of discussion. ACS 2018 may be one of the first times certain businesses reveal new identities and company visions, and we look forward to celebrating and commemorating their evolution,” she says. As the coatings industry continues to consolidate, Rich Stewart, marketing manager for Coating Resins (Americas) with OMNOVA Solutions, also believes that ACS offers paint companies the opportunity to find partners that will work with them on paints that are smarter, perform better, are more environmentally preferred, and have a lower cost-in-use.

Largest Coatings Show in North America

One of the key features of the American Coatings SHOW is that it is the largest coatings show in the Americas and draws a global audience. “ACS is among the most important global shows in which allnex participates. It provides a venue for interacting with many different customers, suppliers, and other exhibitors in one location, as well for introducing new technologies and understanding market trends in innovation,” says Paul Juras, Crosslinkers global marketing director at allnex. For Scott Zimmerman, manager of U.S. national sales for Atlas Material Testing Technology LLC, ACS provides access to the largest gathering of coatings experts, networking possibilities, and customer contacts within the U.S. coatings market.

ACS has increased significantly over the five biennial events held to date—with exhibitor and attendee numbers rising from 331 and 5,600 in 2008 to 559 and 9,100 in 2016, respectively.

Compared with other coatings shows, which often have a limited scope because they focus on specific industries, the ACS provides the best opportunity for industry suppliers like Covestro to promote their entire portfolios of products to coatings producers and the overall industry, according to Aleta Richards, the company’s head of Commercial Operations for Coatings, Adhesives and Specialties (CAS). “During the ACS, we have a chance to share our latest innovations with a wide audience of participants who attend our educational sessions and visit our booth in search of the next game-changer to adapt in their portfolio,” agrees Brandon Devis, Clariant’s director of sales and marketing for Coatings in North America. Because of its size and scope, the American Coatings Show also makes it possible for companies to stay current on the newest technologies in the industry and the changing landscape of companies, according to Hayden.

Of course, the real value of the show is derived from the actual projects that are generated from meetings at the event. ACS is important for Michelman because the company’s experts get to meet with top coatings development decision-makers for high-level exchanges of information and relationship building, according to Hurban. “We are always pleased with the number of customers that we connect with at the show and the new customers and technical projects we generate as a result of discussions on the show floor,” notes Grunwald.

Glasser sums up ACS very well: “The American Coatings SHOW provides an intimate platform for attendees and exhibitors to discuss their aspirations and challenges. ACS is very versatile; coatings companies of all sizes throughout North America have an opportunity to showcase their products and technologies and collaborate with one another. As participants walk through the trade show floor or listen to the conference’s technical presentations, they can learn from the large global coatings companies, as well as regional, niche coatings companies, and service providers.”

Tracking Industry Trends

Perhaps gaining a greater understanding of current market trends and dynamics is as essential a benefit of participation in ACS as are the opportunities to meet with existing and potential customers and suppliers. One key trend identified by many exhibitors in the show is the increasing demand for high-performing coatings that comply with tightening regulations. “These expectations translate to automotive and industrial coatings that meet tighter VOC requirements and last longer in tougher environments, coatings for metal packaging that protect food better without using BPA, and additive and binder innovations that enable architectural coatings to deliver premium performance without introducing VOCs or odor,” Willoughby observes.

Indeed, Covestro, like many other suppliers, expects to see a continued emphasis on more environmentally friendly, efficient, functional, and sustainable coatings technologies, according to Richards. “There is a clear trend towards sustainable, ecological, and energy-saving coating systems, which increases the demand for colorants, pigments, and additives to enable the development of these products,” says Stefan Richter, technical sales representative for Additives with Clariant. Innovation around “greener” technologies and sustainable inputs and technologies that address chemicals of concern and regional regulatory trends are on allnex’s radar, according to LRA regional marketing manager Tim Kittler. He also anticipates the issue of cost-in-use and how to drive cost down while meeting current market performance expectations to be addressed at ACS 2018. In addition to an emphasis on waterborne technologies and improvement of their performance, Bird believes many exhibitors and attendees will be looking for solutions to questions related to coating aesthetics, including color development, gloss control, surface texture and feel, while making it simpler to achieve and control such effects.

General market trends will also be reflected in the conference presentations and show exhibits in 2018, according to McNair. Those he notes are of most importance include the impact of supply/demand on availability and cost of critical raw materials for paints and coatings, the growth in demand for coatings in Asia Pacific, and the unprecedented levels of capital investment by the chemical industry in the United States. “The increase in demand for raw materials by our industry, linked to the growth of the U.S. economy this past year in general, and the growth of the chemical industry in particular, has caused demand to exceed supply in a number of critical sectors of the coatings industry. This, in turn, has caused raw material prices to expand significantly for the first time since the recession,” he notes. In addition, growing demand in China, coupled with the closing of chemical plants by the Chinese government—particularly in the last half of 2017—is further impacting the availability of raw materials in the rest of the world. “Unfortunately, the investments in U.S. raw material production capacity will not impact supplies for several years, likely leading to further increases in raw material prices during 2018,” McNair adds.

Continued merger and acquisition activity across the paint and coating value chain will also likely continue as companies find ways to be competitive in the marketplace, according to Hayden. “Consolidation of suppliers and paint manufacturers is a key industry trend driving greater competitive intensity. Paint manufacturers as a result continually look for differentiating technologies,” says Stewart. He notes several examples, including resins with rust-inhibitors that provide better corrosion resistance, resins that reduce labor by being one-part vs two-part, exterior paint and deck resins that are resistant to early rain to allow painting/coating to happen at any time with better results and customer satisfaction, among others. “In general,” he says, “new resin technologies must do more to prevent surfactant leaching, prevent whitening/blushing, prevent rust, block existing stains, and resist new stains.”

Anticipating New Themes

In addition to ongoing trends, there will be a number of emerging trends for attendees to discover at ACS 2018. Janis expects to see new technologies designed in response to advances in other technologies, including artificial intelligence, machine learning, and lighting. He also anticipates new tools, such as drones and robots that inspect and/or paint, applying more efficient coating layers at lower cost, and lightweight paints containing less pigment that still achieve greater coverage and are easily applied by a robot with zero defects. “These and other trends are driven by environmental/regulatory, cost, and product performance needs. The industry is always improving, and the consumer is always benefiting,” he asserts.

The development of electric and self-driving cars is motivating emerging trends within the automotive industry, according to Grunwald. “The demand for lighter-weight materials will lead to new alternatives to steel substrates, and the resulting technology changes will lead to new innovations,” she explains. Digitalization is another emerging trend that offers many opportunities for the coatings industry, from the way supplies are ordered to improving production processes, according to Richards. “We expect digitalization to be a big part of the conversation at ACS,” she states.

Overall, notes Willoughby, greater competition in the coatings industry will lead to increasing cost and performance pressures and, he believes, more desire for universal solutions that enable coatings producers to reduce the number of raw materials required to produce their growing portfolios. “More specifically, new mobility trends will inject a bias toward automotive solutions that are cleaner and look good longer and for can coatings, we expect to see a strengthening of the move toward BPA-NI coatings, which is catalyzing the creation of a multitude of products that likely bring sacrifices in terms of cost and performance,” Willoughby adds.

Another specific example of an emerging trend is growing interest in waterborne resins for intumescent coatings, according to Stewart. “The market is moving away from cementitious coatings to cellulosic technology and from solventborne to waterborne solutions in the intumescent space. As the world continues to experience more urbanization and crowding, recent high-rise fires around the world have raised concerns about safety. New waterborne intumescent technology is playing a role in providing important safety measures while enabling architects to design buildings more creatively and less expensively than with older technology,” he explains.

With consumer demands playing a large role in technology development, coatings that respond to those demands, including multi-functional and high-performance coatings, are likely to continue to be priorities, according to Glasser. “The key here is to have our eyes and ears open to current market needs and try our best to anticipate what may be in demand in the future. If we can have a handle on that, we’ll be on a path to continued success,” she says. As one example, Zimmerman expects to see trends in quick custom color matching in the architectural industry as art and fashion drive end-use customer expectations.

With consumer demands playing a large role in technology development, coatings that respond to those demands, including multi-functional and high-performance coatings, are likely to continue to be priorities, according to Glasser. “The key here is to have our eyes and ears open to current market needs and try our best to anticipate what may be in demand in the future. If we can have a handle on that, we’ll be on a path to continued success,” she says. As one example, Zimmerman expects to see trends in quick custom color matching in the architectural industry as art and fashion drive end-use customer expectations.

“BASF has seen an increased industry focus around smart coatings,” remarks Mary Ellen Gustainis, business manager for Formulation Additives. “Our customers are looking for ways to add functionality within their coatings. A great example of this focus is ice phobic coatings, which are formulated specifically for ice resistance and are effective at preventing ice build-up on everything from jet engines to ship decks to runways. This innovative coating technology enables a higher in-service time and reduced maintenance labor costs,” she observes.

Another emerging trend, according to Glasser, is the role that technological solutions across the supply chain play. “While companies have used technology for decades to enhance their innovation and operations, we expect an adoption of technology to accelerate, particularly in the area of improved efficiency and supply chain capabilities,” she notes. The result: new ways of innovating and operating, from online paint delivery services or paints that incorporate technology as ingredients, to robotics used to improve R&D and manufacturing processes.

Underscoring Innovation

“Indeed, the coatings industry is ripe for disruption and now is a great time to push for continued innovation—innovation that pushes the entire industry forward,” according to Glasser. “Our primary goal for ACS 2018 is to showcase the capabilities that allow us to act as a true partner to our customers. We’re a supplier that values intimate and ongoing collaboration, enabling us to advance the coatings industry with our customers as we help them achieve diverse goals, from resolving formulation or performance challenges to pursuing new chemistries or sustainability targets,” she asserts.

Many suppliers have a similar view of ACS, seeing the show as an opportunity to highlight their ability to offer solutions and not just products. King Industries will convey its value as a technical resource for its customers. “We are willing and ready to help our customers solve specific problems and achieve desired performance goals,” Grunwald comments. Covestro will demonstrate its leadership and commitment to providing innovative solutions for the coatings industry, and Michelman will further establish itself not just as an additive supplier but as a developer of waterborne coatings solutions and a supplier that collaborates with customers to help them overcome their challenges.

BASF’s efforts to understand its customers’ customers and overall market needs will be reflected in the solutions presented by the company that enable its customers to meet present day market demands. Evonik will be promoting its depth of technical expertise and the “One partner. Many experts.” strategic approach to delivering integrated solutions to the coatings industry. OMNOVA Solutions wants to engage with customers to collaborate and develop both incremental wins and market-changing innovations, network with industry partners to form synergistic relationships where the company can add value, and perhaps most importantly gather the voice-of-customer. Questions Stewart and his colleagues will help manufacturers answer include “What paint challenges are out there? What new problems are paint companies trying to solve? What is that wish list? What new products do they want OMNOVA to help them develop/innovate?”

Allnex and Polynt-Reichhold will also be reintroducing their companies, both of which recently completed mergers. For allnex, ACS 2018 will be the first show since it integrated with Nuplex. “We’ll be reminding visitors about our new, combined allnex portfolio and our ability to meet customers’ needs in a variety of segments,” says Juras. “We have strong brands from both organizations and will be showing how we have come together to be an even more powerful force in the industry,” he adds. Polynt-Reichhold wants to inform the industry about how the resins businesses of Reichhold and Polynt as one company offer a more complete line of products than either company could separately, according to Hayden. “We also want the industry to know that we will continue to offer new and innovative products,” he says. Evonik will be introducing its larger and restructured business created following the acquisition of the Performance Materials Division of Air Products and other organic expansions and giving “virtual tours” of new facilities, including its fully automated plant with high throughput equipment, according to Thomas Lange, the company’s manager of communications for Coating Additives.

Clariant will be promoting color and where it is going with its 2019 global Automotive Styling Shades Trendbook, which presents the color areas that will play a role in the automotive industry in the future, according to Devis. The collection of automotive styling shades in the Automotive Trendbook is based on Clariant’s color know-how and observations of social trends, topics, and industry developments. “The Trendbook includes analyses of color popularity and offers innovative solutions based on our organic pigments. The focus of our 2019 automotive styling is Marine Magic . . . colors above and below the water,” he observes.

Product and Service Highlights

Resins

Given the expectations for an increasing emphasis on sustainable solutions, many exhibitors are highlighting waterborne resins for a wide variety of coating applications. Dow Coating Materials will promote its award-winning CANVERATM Polyolefin Dispersions for the formulation of sustainable alternatives to traditional epoxy-based resins for metal can coating systems; ROPAQUETM Opaque Polymers for BPA-free thermal paper; and FASTRACK™ Resins for durable, waterborne road-marking coatings. Lubrizol Performance Coatings will exhibit new water-based resins for improved corrosion protection and new post-addable technology for matting and texturing in powder coatings.

Evonik’s Functional Silanes business will highlight Dynasylan SIVO 140, a waterborne, VOC-free binder for zinc silicate paints for protective and marine applications and some interesting application data for silanes in UV-curable coatings, according to Sheba Bergman, applied technology manager for NAFTA. BASF will be featuring three new products, including Joncryl OH 8314, a polyol dispersion made using a unique platform that allows for careful tuning of colloidal stability. The dispersion has a nominally low OH value but can provide good chemical resistance, high hardness and gloss, and can be formulated in clear coats with very low haze. It is suitable for use in topcoats and DTM applications. Also highlighted will be Acronal EDGE 4247, a high-performance, all-acrylic latex designed for exterior flat to semi-gloss paints that unites the requirements of a primer and topcoat. In addition, the company will spotlight Laromer UA 9134 and Laromer LR 9112, two UV-curable PUDs. The former is an aliphatic polyurethane dispersion with acrylate functionality that contains reactive diluents, while the latter is an acrylate functional aliphatic PUD with hard segments in the polymer chain and an intrinsic dispersing agent.

OMNOVA is launching four new products at ACS 2018. Hydro Pliolite® 211 is a waterborne resin with good char formation and water resistance that enables the formulation of durable intumescent coatings for use on interior/exterior applications, even under high humidity conditions. Pliotec® SC203 is a non-blushing waterborne concrete sealer resin for use in low-VOC, APE-free clear or pigmented concrete or tile sealers. It offers improved whitening/blush-resistance, adhesion to multiple substrates, and good hot tire stain and tire pick-up resistance. Pliotec LEB20 is a waterborne resin for exterior paints and coatings based on proprietary technology that offers excellent water resistance, resists surfactant leaching and efflorescence, and provides excellent early-rain resistance. Pliotec HDT16 is a resin offering water and corrosion resistance for high-gloss, DTM paints and metal primers that is also well-suited for use in multi-substrate coatings due to its excellent adhesion properties.

Pflaumer Brothers will introduce Teracure® NX-19 and Teracure NX-16, new low-viscosity, solvent-free aliphatic trimer polyisocyanates based on hexamethylene diisocyanate that were developed to extend the working time for polyaspartic coatings by 30–80%. “These resins provide greater flexibility, and solvent-free polyaspartic coatings can be formulated due to the low viscosity of both (450 cps and 550 cps, respectively),” says McNair. The company will also be highlighting polyaspartic coating technology—one-coat, reactive, 100% solids polyaspartic coatings to replace multi-coat epoxies and urethanes for concrete (floors), steel (bridges), and composites (wind turbines). Pflaumer has also developed a unique self-leveling composite of concrete (Portland, lime, sand) and its water-based urethane polymer (prepared using green chemistry) to make concrete both many times stronger, and chemical, stain, and thermal-shock resistant. Tallicin® E-16, a saturated polyester polyol with butyl acetate for high-performance solvent-based urethane coatings that resists corrosion and deterioration when exposed to harsh environments will also be presented. A version of Tallicin E-16 using Oxsol 100 is also available for very high-solids urethanes. Tallicin E-16 is used to improve the chemical resistance of polyaspartic coatings. “Our business strategy is focused on developing products and technology involving the use of renewable resources, reduction and elimination of VOCs, and a special emphasis on the use of alternative sources of energy,” COO Craig McNair says.

Polynt-Reichhold will feature its Becksol AQ product line based on alkyd emulsion technology, including a new unique direct-to-metal offering. The company is also promoting UROTUF F108-T8W-45, a high-solids, anionic stabilized, low-VOC, and NMP-free waterborne oil-modified urethane provided at 45% solids in a blend of tripropylene glycol mono methyl ether (TPM) and water that can be formulated into low-VOC varnishes (<100 g/L) with the addition of metallic driers. UROTUF F275 is a solventborne, oil-modified urethane for the formulation of 275 g/L VOC varnishes that addresses the need for lower VOC urethane formulations without sacrificing the toughness and durability inherent in conventional urethanes, according to Hayden.

Eastman is also highlighting a new line of resins. Tetrashield™ protective resins enable the formulation of more durable, rugged, and chemically resistant coatings, according to Willoughby. For automotive monocoats, Eastman Tetrashield AC1000 and AC1001 offer superior weathering and durability while simultaneously enabling a 10–15% increase in solids. For metal packaging, Tetrashield MP2000 offers a unique combination of high flexibility and corrosion resistance from a BPA-NI resin. For industrial coatings, Tetrashield IC3000 and IC3020 offer improved durability and chemical resistance for ACE and industrial applications.

Additives and More

Although only used in minute quantities, additives can have huge impacts on the processing, application, and applied performance of paints and coatings. They have become increasingly important for addressing performance challenges of more sustainable waterborne and high solids systems. It is no surprise, therefore, that many exhibitors at ACS 2018 are highlighting new additives, driers, curing agents, and other solutions designed for use in more sustainable formulations.

In addition to resins, Lubrizol will showcase new waterborne hyperdispersant technologies with improved coloristic and film property performance. The company will feature its Aptalon™ polyamide technology for long-lasting durability in waterborne coatings, including a new version with inherent matting for low-gloss applications. Troy Corporation is also highlighting dispersant technology—its new Troysperse™ ZWD “green” pigment dispersants for aqueous systems promote excellent pigment dispersion at low use levels for optimal cost-in-use, and are environmentally friendly, according to vice president of marketing Frank Cangelosi.

Troy will promote its latest Polyphase® CR technology, next-generation controlled release dry-film fungicide + algaecides. These preservatives are highly resistant to leaching, resulting in remarkably long-lasting coatings protection, according to Cangelosi. The latest Mergal® wet-state preservatives, which offer “quick kill” activity, long-lasting protection, and additional performance and cost-in-use benefits, are VOC-, APE-, and formaldehyde-free. Powdermate® powder coating additives, engineered for applications ranging from automotive to general industrial, provide degassing, flow & leveling, and texturing, as well as additional functionalities.

BASF will be focusing on products that enable its customers to do more with less while increasing their process efficiency and reducing steps and labor, according to Gustainis. Tinuvin 249 is a liquid, non-basic HALS for coatings that is designed to meet the high performance and durability requirements of all solvent-based automotive, industrial, and decorative coatings where other HALS fail either due to their basicity or for compatibility reasons. AQACell 6299 is an opacifying polymer used to reduce TiO2 loading by as much as 40% without impact to opacity. “This product provides substantial improvements to formulated costs and greenhouse gas footprints, addressing the need for new technologies that have sustainability in mind,” Gustainis says.

BASF will be focusing on products that enable its customers to do more with less while increasing their process efficiency and reducing steps and labor, according to Gustainis. Tinuvin 249 is a liquid, non-basic HALS for coatings that is designed to meet the high performance and durability requirements of all solvent-based automotive, industrial, and decorative coatings where other HALS fail either due to their basicity or for compatibility reasons. AQACell 6299 is an opacifying polymer used to reduce TiO2 loading by as much as 40% without impact to opacity. “This product provides substantial improvements to formulated costs and greenhouse gas footprints, addressing the need for new technologies that have sustainability in mind,” Gustainis says.

For the first time, Huber Engineered Materials will be offering its line-up of four Pergopak® organic matting and effect agents, which it acquired in 2016 with the purchase of the Martinswerk business from Albemarle. The Pergopak organic matting and effect agents impart gloss reduction, flatting and matting at lower viscosity with improved abrasion, mar and scratch resistance, and softer feel and touch versus other matting agent technologies, according to Sorrell. Huber is also promoting the Hubercarb® W Series calcium carbonate products, all of which are silica-free. Because they contain very low moisture, low leachable chlorides, and low heavy metals, these additives are suitable for use in moisture-

sensitive formulations.

Michelman will be introducing Michem® Wood Coating 44, a new waterborne surface additive for use in exterior wood stains and sealants. The low-VOC, topical wood treatment helps produce wood coatings with excellent weatherability characteristics by imparting outstanding water beading, along with excellent water and swell resistance, according to Hurban. The additive helps to improve surface aesthetics by slowing mold and fungal growth and penetrates deep into wood substrates, and thus does not cause re-coatability issues.

King Industries will be featuring a new urethane diol capable of reducing the amounts of amine neutralizer and coalescent solvent in waterborne paints. K-FLEX® urethane diol is 100% solids and fully water-soluble with low viscosity that allows for easier resin incorporation. It also enhances the performance of aminoplast crosslinked coatings with improved properties such as humidity and salt spray resistance and increased film hardness without loss of flexibility. The company is also introducing a new metal-free alternative catalyst for the lower-temperature cure of epoxy-carboxy coatings. The NACURE® catalyst is easily incorporated into the formulation and provides good weathering resistance and a potential for formulating stable 1K coatings, according to Grunwald.

ADDITOL® dry CF Series of cobalt-free paint driers will be promoted by allnex. “Cobalt is facing global regulatory pressure due to reclassification, and we have developed a new line of paint driers that meet or exceed the performance of cobalt-containing driers performance without the use of cobalt,” says Kittler. The company will also be presenting other green initiatives and technologies based on the use of renewable and recycled raw materials, reduction of chemicals of concern, reduction of energy consumption, and increased product longevity.

Pflaumer Brothers, in addition to its polyurethane polymer- based products, will be introducing new hardeners for use in epoxy floor coatings and other applications.

Clariant will feature Dispersogen® SPS and Dispersogen SPV stabilizers for increasing the lifetime (storage stability) and improving the handling properties of biocide-free, mineral-based paints that have better vapor permeability and are inherently less allergenic for healthier indoor climates, according to Jeff McManus, business manager, Paints and Coatings, North America. The company will also highlight Ceridust® 8090 and Ceridust 8091 for improving the scratch and mar resistance and providing a “natural wood” touch in wood coatings. Exolit® AP 435 provides a prolonged shelf life for water-based intumescent flame retardant coatings, while AddWorks® LXR 308 light stabilizer is designed for use in car refinish and wood coatings with enhanced weathering performance and does not interact with UV curing or metallic catalysts. Light stabilizers from Clariant include toluene- and xylene-free Hostavin® TB-03 for high performance solvent- and waterborne coatings and Hostavin 3070, a high molecular weight HALS with excellent thermal stability, low volatility, resistance to migration and extraction that is also EU Ecolabel compliant.

Evonik is highlighting a number of new product developments, including new Airase® 5355/5655/4655 and Surfynol® 355 specialty additives for use in food-contact packaging, all originally developed by the Specialty Additives business of Air Products. These products offer outstanding performance and comply with the requirements of the relevant regional and national regulatory authorities in many countries, according to Rebecca Marshall, sales and marketing associate for Coating Additives with the company.

Pigments

Clariant will be introducing attendees to its newest production plant for solvent-based pigment preparations (dispersions), located outside of Mexico City, which was inaugurated in 2017. The plant more than doubles Clariant’s annual production capacity in Mexico for solvent-based pigment dispersions and enhances its ability to serve customers across North and Latin America, according to Devis. “The strategic location in North America allows us to better tailor our offerings to specific customer and application needs within the region,” he observes. With respect to specific products, the company will be highlighting intermixable product ranges meeting opaque color trends in traditional applications (Hostatint A 100) and highly transparent individualized styling shades in high-end applications (Hostatint A 100-ST). For wood coatings, Clariant will be promoting sustainable pigment dispersions (Hostafines for water-based systems and Hostatint UV for 100% UV systems) and highly transparent Hostafines that Devis says offer higher fastness properties when compared with dyes.

Clariant will be introducing attendees to its newest production plant for solvent-based pigment preparations (dispersions), located outside of Mexico City, which was inaugurated in 2017. The plant more than doubles Clariant’s annual production capacity in Mexico for solvent-based pigment dispersions and enhances its ability to serve customers across North and Latin America, according to Devis. “The strategic location in North America allows us to better tailor our offerings to specific customer and application needs within the region,” he observes. With respect to specific products, the company will be highlighting intermixable product ranges meeting opaque color trends in traditional applications (Hostatint A 100) and highly transparent individualized styling shades in high-end applications (Hostatint A 100-ST). For wood coatings, Clariant will be promoting sustainable pigment dispersions (Hostafines for water-based systems and Hostatint UV for 100% UV systems) and highly transparent Hostafines that Devis says offer higher fastness properties when compared with dyes.

Testing Equipment

Atlas Material Testing Technology is introducing a number of new instruments and services for weathering testing. The Atlas Ci4400 Weather-Ometer® has several new ergonomic features for easier operation. The SUNTEST XXL+ ST is a flatbed weathering instrument specifically designed for accelerated testing of automotive exterior and interior materials per SAE standards. With an extra tall test chamber, it particularly addresses the needs of three-dimensional parts and components testing, unlike other test chambers, according to Zimmerman. The instrument is ready for network integration, has an access port for external sensors, and has all relevant test methods pre-programmed for Quick-start. The Ultra-Accelerated EMMA (UA-EMMA) is a new outdoor testing device that provides radiation exposure in one-year equivalent to that received in South Florida in approximately 10–12 years. This new solar concentrator technology utilizes the same “cool mirror” technology used in its Ultra-Accelerated Weathering System (UAWS). Similar in concept to Atlas’ Equatorial Mount with Mirrors for Acceleration (EMMA®) technology, the new ultra-accelerated EMMA device tracks the sun while concentrating reflected sunlight on test specimens mounted in a target area. The Specific Specimen Surface Temperature (S3T) system measures the surface temperature of exposed samples during accelerated laboratory weathering for comparison of temperatures between artificial and natural weathering exposures, estimation of theoretical acceleration factors, activation energy determination, correlation studies, and service life prediction.

Software and Digital Experiences

Covestro will be launching two new products and services at ACS: one for the fenestration industry along with a new digital tool to help formulators with the formulation process. The new digital tool was developed in response to customer demand and helps formulators get a jumpstart on the formulation process based on the desired haptic feel and performance properties of the coating they are formulating, according to Richards.

Lubrizol, meanwhile, will be showcasing its latest coating technology innovations using an interactive, augmented reality experience. Through augmented reality, customers can experience the unique performance, simplicity, and sustainability benefits that Lubrizol products can bring to their coatings in a fun and educational way, according to Bird.

Considering the wide range of technologies being featured at the 2018 American Coatings SHOW and CONFERENCE, the event promises to offer solutions to many of the coatings industry’s most pressing challenges.

CoatingsTech | Vol. 15, No. 3 | March, 2018