By and , Ph.D., The ChemQuest Group, Inc.

Megatrends are wide-reaching, critical forces that shape our society and long-term economic and technological landscape, from which the paint and coatings industry is by no means exempt. These trends are both drivers of innovation and boundaries defined by external pressures (e.g., regulatory constraints, evolving consumer values, and technological advancements) that companies must navigate to remain competitive.

Part 1 of this article series, published in CoatingsTech’s May-June 2025 issue, focused on the impact that megatrends such as sustainability, health awareness, mobility, and digitalization have on the North American paint and coatings industry. For the purposes of this article, we will explore these trends (and others) with a wider perspective, primarily through the lens of Europe and Asia.

Environmental Sustainability

European manufacturers are under a unique set of pressures driven by some of the world’s strictest environmental regulations, including the European Union (EU) Green Deal and Registration, Evaluation, Authorisation, and Restriction of Chemicals (REACH). These rules require continual reformulation of products to lower volatile organic compound (VOC) emissions, reduce dependency on fossil fuels, and embrace bio-based and other renewable raw materials. In response, companies are not only reengineering their formulations but also revamping production processes to align with green and circular economy principles. As a result, environmental sustainability has become key to industry strategy, offering an immediate competitive advantage in markets where both regulators and end users highly value ecocredentials.

Across Asia, governments and consumers are increasingly concerned with environmental degradation and air quality. This growing awareness has pushed manufacturers to develop low-VOC and VOC-free coatings, as well as formulations that incorporate recycled or bio-based materials. In markets such as China, where environmental regulations are tightening to combat pollution, sustainability is becoming a strategic imperative. Furthermore, with the region’s rapid industrial growth and construction boom, there is a heightened drive to reduce the ecological footprint of manufacturing processes and end products.

Globally, changes are apparent throughout the vertical supply chain. AkzoNobel has reformed its product portfolio by expanding its range of waterborne and powder coatings. These formulations are designed to lower VOC emissions and use renewable, bio-based raw materials. Hexion has advanced its development of waterborne and high-solids resin systems. By replacing conventional, fossil fuel-derived chemicals with bio-attributed alternatives, Hexion supports a reduction in environmental footprint while maintaining the performance expected of high-quality coatings.

Resin manufacturer Worlée has taken advantage of the thriving regional cultivation of the camelina plant in Germany to develop a series of functionalized camelina oil-based resins, capable of application in alkyd resins, polyurethane systems, and dispersions. The camelina plant, a non-food crop requiring minimal water and reduced levels of pesticide, is an example of climate-adaptive agriculture.

Additives supplier Evonik recently introduced a range of 100% plant-based biosurfactants made via the fermentation of sugar. These glycolipids are fully biodegradable and exhibit enhanced wetting and color retention properties in waterborne coatings.

Ecoat in France has secured significant investment (over €21 million) to scale up its production of sustainable, bio-based paint binders, which are designed to replace petrochemical-derived polymers and lower GHG emissions throughout the coatings’ life cycle. The company’s Secoia® 1501 product is part of a drive to reduce the environmental footprint of coatings, particularly for indoor architectural applications.

DIC introduced its water-based barrier coatings in 2023, initially for trial applications in the Indian market. These coatings are designed to enhance the performance of packaging substrates by improving oxygen barrier and sealing properties. By using a water-based system instead of traditional solvent-based formulations, the company can significantly reduce the emission of VOCs and lower the overall environmental footprint. This transition to water-based technology not only minimizes the reliance on petroleum-derived chemicals but also supports the shift toward more eco-friendly packaging solutions.

Health Awareness

Health awareness in Europe is deeply embedded in product development and regulatory practices. European consumers demand products free of harmful chemicals, and industries are under constant pressure to replace substances of concern—a trend reinforced by stringent legislative frameworks. In a 2025 survey conducted by IMCD focusing on trends within the coatings and construction industries, 30% of respondents ranked the topic of “Healthy Future” (i.e., emphasizing the creation of safer formulations) in first place. This is a surge from 18% in the previous 2023 survey, supporting the shifting focus within the industry.

In response to the COVID-19 pandemic and an overall heightened focus on well-being, many paint and coatings companies accelerated research into antiviral and antibacterial coatings. During the last three years, R&D teams have submitted record numbers of proposals aimed at creating surface formulations capable of inactivating pathogens. These innovative coatings, which are being tested in settings like hospitals, public transportation, and commercial spaces, not only improve indoor air quality and promote sterile surfaces but also signal a broader shift toward products that prioritize consumer and worker safety. For such coatings, health and safety are as crucial to product performance as traditional attributes like durability and appearance.

In response to the COVID-19 pandemic and an overall heightened focus on well-being, many paint and coatings companies accelerated research into antiviral and antibacterial coatings. During the last three years, R&D teams have submitted record numbers of proposals aimed at creating surface formulations capable of inactivating pathogens. These innovative coatings, which are being tested in settings like hospitals, public transportation, and commercial spaces, not only improve indoor air quality and promote sterile surfaces but also signal a broader shift toward products that prioritize consumer and worker safety. For such coatings, health and safety are as crucial to product performance as traditional attributes like durability and appearance.

The global antimicrobial coatings market, valued at over $13 billion in 2024 (Europe and “rest of the world” representing 55% of that total), is expected to grow over the next 10 years with a strong compound annual growth rate (CAGR) of more than 12%. Silver-based antimicrobial coatings are still predominant, using additives from suppliers like UK-based BioCote®, which have high efficacy against several viruses, bacteria, and other microorganisms.

Switzerland-based Arxada (including Troy Corp.) is pioneering the development of quaternary ammonium compounds (quats) as an alternative to traditional metal-ion (e.g., silver, copper)-based additives. Furthermore, the company’s TIME (Technology for Innovative Micro-Encapsulation) portfolio of controlledrelease additives enables long-lasting, dryfilm protection against microbial threats, with the potential to enable hazard labelfree paints.

Mobility

European urban planning and public policy continue to promote sustainable mobility. With a high concentration of compact cities and an established public transport network, Europe is shifting toward integrated, low-emission transportation methods that influence adjacent sectors, including the coatings industry—in which materials must meet new performance standards for emerging transportation applications.

The rapid growth of electric vehicles (EVs) has led automotive coatings manufacturers in the last few years to introduce lightweight, high performance coatings engineered for battery enclosures and other EV components. These specialized formulations offer improved heat resistance and electrical insulation while reducing weight and ensuring durability—key properties needed as automobile manufacturers transition from traditional combustion engines to EVs.

The rapid growth of electric vehicles (EVs) has led automotive coatings manufacturers in the last few years to introduce lightweight, high performance coatings engineered for battery enclosures and other EV components. These specialized formulations offer improved heat resistance and electrical insulation while reducing weight and ensuring durability—key properties needed as automobile manufacturers transition from traditional combustion engines to EVs.

At The Battery Show Europe in Stuttgart, Germany, PPG spotlighted its advanced portfolio, including coatings engineered for battery cells, modules, and battery packs. These coatings are designed to offer improved fire protection, effective thermal management, and enhanced durability. Arkema is pursuing battery cell protection by means of UV-curing dielectric coatings, which allow optimization of the manufacturing process while ensuring cell isolation without film delamination.

In Asia, rapid economic growth and government incentives for electric mobility are creating a dynamic market environment. Local manufacturers are scaling up production facilities and investing heavily in R&D to deliver coatings that support the structural integrity and safety of nextgeneration vehicles. Nippon Paint is leveraging its strong R&D capabilities to innovate coatings for the EV market. In Japan and other parts of Asia, the company is exploring corrosion-resistant and thermally stable coatings that cater to the heightened demands of EV battery systems and chassis protection.

Digitalization

Manufacturers are integrating advanced data analytics, internet of things (IoT) sensors, and digital twin simulations into their production systems to optimize efficiency, quality control, and waste reduction. Europe’s strong digital infrastructure, combined with stringent rules on data usage and privacy such as General Data Protection Regulation (GDPR), has spurred the development of digital tools tailored for customer engagement and operational excellence. For instance, augmented reality (AR) applications that help clients visualize paint finishes before purchase are becoming standard. Asia is at the forefront of digital transformation, and the coatings industry is rapidly embracing new technologies to stay competitive in a region known for its fast pace of innovation.

AkzoNobel has introduced AR applications that allow customers to preview colors and finishes in a virtual environment. This digital tool not only enhances the customer experience by letting them visualize outcomes before a purchase decision is made, but it also helps reduce product returns and shortens the design cycle.

Nippon Paint has deployed mobile applications and web-based platforms that enable customers to explore product ranges, preview color schemes, and place orders digitally. By creating an interactive and accessible digital channel, Nippon Paint seeks to improve customer engagement and streamline the customization process to better meet local market needs.

PPG has invested in creating digital twin simulation platforms that mirror its production lines. By coupling these virtual replicas with IoT sensor data, PPG can monitor manufacturing operations in real time. This approach enables predictive maintenance and reduces waste and downtime while enhancing the overall quality and consistency of the company’s coatings, an approach also adopted by Kansai Paint in Japan. PPG can even offer digital twin visualizations to clients, providing transparent windows into product performance and lifecycle management.

Automated digital testing facilities at AkzoNobel’s UK location feature a purpose-built digital testing center used to simulate harsh environmental conditions. By digitally replicating variables like humidity, temperature fluctuations, and UV exposure, the facility accelerates product validation and helps fine-tune formulations. This concept has been adopted at DIC Corp.’s virtual R&D and simulation labs, which allow for rapid prototyping and testing of new formulations under simulated environmental conditions.

Urbanization

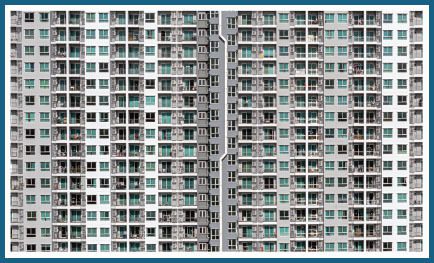

Asia is currently home to seven of the world’s top 10 megacities (i.e., urban agglomerations with over 10 million inhabitants, as defined by the United Nations). This rapid urbanization is transforming city landscapes and, with that, reshaping the requirements and opportunities within the coatings industry.

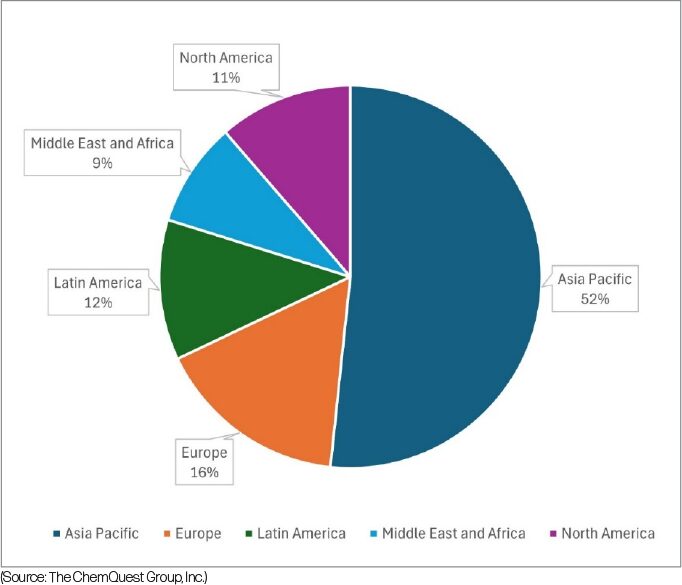

As sprawling megacities face challenges like heavy vehicular emissions, acid rain, and accelerated wear on building materials, paint companies are innovating their product formulations and application techniques to meet these new demands. Currently occupying an estimated 52% of the global decorative architectural coatings market by volume, the Asia-Pacific (APAC) region represents a sizeable and growing opportunity for new technologies (see Figure 1).

FIGURE 1: Decorative architectural coatings volume by region, 2024 (estimated). Source: The ChemQuest Group, Inc.)

Kansai Paint has focused on waterborne coatings that are both environmentally friendly (thanks to their low-VOC content) and engineered for enhanced durability. These coatings are optimized for contemporary urban infrastructures such as high-rise apartment complexes and commercial centers, with the goal of delivering superior resistance to weathering and pollutants common in cities like Tokyo, Jakarta, and Seoul.

Jotun has introduced advanced exterior coatings tailored for polluted urban environments. These coatings combine low-VOC profiles with self-cleaning properties that help reduce maintenance costs and enhance appearance over time. In cities like Singapore and Shanghai, Jotun’s products have been instrumental in supporting sustainable urban development by mitigating the adverse effects of industrial and vehicular emissions on city structures.

Nippon Paint has expanded its portfolio for urban applications by developing photocatalytic coatings. These innovative formulations not only provide aesthetic appeal but also use photocatalysts to break down pollutants on building surfaces, thereby helping to improve air quality in densely populated cities. This technology is particularly useful for high-rise commercial and residential towers where constant exposure to urban pollutants accelerates degradation.

Conclusions

As we review the European and Asian coatings markets, the impact of today’s megatrends can be observed. Companies throughout the supply chain are reacting to the different driving forces, including:

- New legislation and regulation;

- Growing awareness and concern among consumers regarding their personal well-being and the health of the planet;

- Impact of new digital technologies;

- Paradigm shift in the automotive market;

Effects of a rapidly growing population; and - Changing demands of an increasingly more well-informed consumer.

We have noted that coating manufacturers are heavily investing in eco-friendly formulations such as waterborne, powder, and bio-based coatings to meet strict environmental regulations and cater to an eco-conscious market. Companies are reformulating products to eliminate toxic chemicals and incorporate antimicrobial features, ensuring safer indoor environments.

Manufacturers are adopting digital tools such as digital twins, IoT-driven production, and AR for customer engagement. These initiatives support efforts to improve quality control, streamline operations, and reduce waste, thereby enhancing efficiency and product consistency.

With the shift to electric vehicles and modern urban infrastructure, there’s a strong push to develop specialized coatings (for battery enclosures, lightweight components, etc.) that deliver enhanced durability and performance under new mobility paradigms. And in Asia especially, rapid urban growth and high pollution levels are pushing manufacturers to create robust, high performance coatings (e.g., photocatalytic and low-VOC types) designed to protect buildings and infrastructures in densely populated cities.

Recognizing and understanding the megatrends shaping the coatings industry is necessary to navigate the complexity of our increasingly global economy. Moreover, aligning innovation and strategic initiatives with these trends not only provides opportunity but is essential for maintaining long-term competitiveness.

is a director with The ChemQuest Group, Inc.

Email: pmarsh@chemquest.com.

is a director with The ChemQuest Group, Inc.

Email: wdaniell@chemquest.com.