By George R. Pilcher, Vice President, The ChemQuest Group, Inc.

The topic of “mergers and acquisitions” (M&A) is one that may seem shrouded in mystery, both for those who make M&A decisions (but are generally not involved in the details of implementation), and for those who are involved in the implementation, but not in the initial decision-making process. This article is intended for the majority of us in the paint and coatings industry who are not involved in the decision-making process regarding whether “to buy or not to buy,” but who must live with, and make work, the outcome of those decisions. At the very least, readers should gain a new appreciation for the elements of M&A activity, and how they affect the final output.

Without referring to a dictionary for strict definitions, the terms “mergers” and “acquisitions” have become somewhat blurred in practical usage, although there are still some definite differences:

- An acquisition is the purchase of one company by another company or business entity, where the acquiring company is clearly the new owner, the acquired company ceases to exist from a legal point of view, and the acquiring company’s stock continues to be traded.

- A merger occurs when two independent companies decide to join forces and go forward as a single new company, rather than as independent entities. Both stocks are surrendered, and new company stock is issued in their place. A good example of such a merger took place when Glaxo Wellcome and SmithKline Beecham merged to form the new entity GlaxoSmithKline.

In even more practical terms, “acquisition” tends to have a pejorative connotation, and so it is not uncommon for a company making an acquisition to allow the company being acquired to refer euphemistically to the transaction as being a “merger,” which carries a much more face-saving connotation. A classic example of this would be the takeover of Chrysler by Daimler, which was widely referred to as a “merger of equals” at the time, although it was widely recognized as nothing of the kind.

A merger will generally be referred to by that term if both CEO’s agree that joining together is in the best interest of both companies. If an unfriendly takeover occurs, however, the deal is virtually always referred to as an “acquisition.”

How Are Mergers and Acquisitions Initiated?

All mergers and acquisition should begin with a strategic plan, although many (perhaps most) do not. This plan should include elements that contemplate the following types of questions:

- In an ideal world, where do I want my business to be in five years, and what do I want my business to be doing? Simply stated: “When I grow up, what do I want to be?”

- How do my current abilities stack up with regard to achieving my strategic goals?

- How much of my strategic plan can be fulfilled with organic growth created by my current abilities and resources?

- What percentage of my strategy will remain unfulfilled unless I also grow inorganically—i.e., through mergers and/or acquisitions?

In a mature market space like coatings, the most common ways that a strategic plan can return value to stockholders is through niche business, movement into adjacent spaces or movement into completely new spaces. Companies in acquisition mode look at the means to achieve future growth from several angles or combinations of these angles, as follows.

Horizontal Growth

A company may want greater market share, especially in a mature market, and a good way to do this is to acquire (or merge with) competitors or a division of a competitor. This not only supplies an infusion of new products and sometimes even new technology (a “technology tuck-in”), but the increased volume generally places the acquiring company in a better raw material purchasing position, and allows it to produce additional product with only incremental cost increase, especially if it purchases only the technology of the acquired company or division, but not the facilities.

The ability to treat the new business as incremental also enhances the bottom line of the acquiring company. An example of this type of acquisition was PPG’s purchase of BASF’s North American Industrial Coatings business in 2008, without purchasing any facilities, thus increasing its market shares in the coil and metal extrusion coatings market segments. Another was the 2009 acquisition of SI Group-Canada, Ltd.’s alkyd technology by OPC Polymers, a major North American producer of alkyd and modified alkyd resins. The latter is an example of an acquisition that served more than a single purpose—it represented both horizontal growth for OPC as well as extension of its geographical positioning. This sort of “multiple angle acquisition strategy” is, in fact, typically at work to one degree or another in most M&A activity.

Vertical Growth

A raw material supplier may wish to begin producing some of the major raw materials made by its customers, to give it a better cost position than its competitors, which are selling only the ingredients for their customers’ products. This is called “forward integration,” and a good example of this occurred early in the past decade when Eastman Chemical, a major supplier of monomers used in alkyds and polyesters, acquired McWhorter Resins as an outlet for its monomers, and as an entrée into the resin market. Another highly publicized example would be Dow’s acquisition of Rohm & Haas.

Unfortunately, Eastman’s acquisition was an example of an acquisition that did not work out (it is said that about 50–80% don’t—more on this later), and Eastman then sold its resin business to Hexion, which was, in turn, merged by its parent company Apollo Management LP with Momentive Performance Materials Inc. to form Momentive Performance Materials Holdings LLC.

A company may also choose to grow vertically by doing just the opposite and backward integrating. An example of this would be a paint company that decides to produce its resins by purchasing monomers directly, rather than purchasing finished polymers and resins from resin suppliers. A paint supplier would generally choose to do this to give itself a better cost position than its competitors that are purchasing resins and polymers from third parties. Good examples of this are AkzoNobel’s Coil and Extrusion Business Unit and its Packaging Business Unit, both of which use monomers purchased by Akzo Nobel to make the resins that are the basis for the coatings that they sell, either all or in part.

Adjacent Market Segments

A company may do this to expand its horizons, enhance its attractiveness as a business, create future growth opportunities, and improve profitability. An example of this type of acquisition would be Sherwin-Williams’ acquisition of Accurate Dispersions from Eastman Chemical Company in 2002, although a case could be made that this is also a backward integration. Another more recent example would be the acquisition of Isothermal Protective Coatings (“IPC”) by Edge Adhesives in 2015, which added elastomeric roof coatings and similar products made by IPC to Edge’s existing lines of adhesive and sealant products used in construction and roofing, thus extending Edge’s market reach into a significant additional segment of the construction industry. Note: The fields of “Adhesives & Sealants” and “Paints & Coatings,” have roughly 85% of their raw materials in common, and very likely a higher percentage of that in terms of common end-users and market segments, yet it is really quite surprising how rarely these commonalities are noted and acted upon. The “blinder effect” tends to cause industry players to view these two product platforms as completely unrelated, which in turn causes potentially value-added merger and/or acquisition activity to go overlooked and unrealized.

Geographical Positioning

In a global economy, suppliers are expected to follow their customers wherever they go. Sometimes building new facilities in strategic global areas makes the most sense, but other times a well-placed acquisition makes even more sense to expand the acquiring company’s brand recognition, incorporate new technologies that may be of specific importance in the new geographical area, establish new relationships and acquire additional customers. Among numerous examples of this type of M&A activity would be H.B. Fuller Company’s 2015 acquisition of TONSAN Adhesives, Inc., the largest independent engineering adhesives company in China, and KODA Distribution Group’s 2015 acquisition of Unipex Solutions Canada, a move that enabled the Stamford, Connecticut-based KODA to enter the Canadian specialty chemicals distribution market space.

Product Line Extensions

This is fairly self-explanatory. If Company A makes alkyds, it may wish to acquire polyester technology from Company B that can be made on the same equipment, or it may have a desire to acquire acrylic technology from Company C to broaden its range of technology offerings to a marketplace in which it currently operates—or to expand its market penetration into segments where it does not currently operate. Examples of acquisitions that had product line extensions as their principal goal are PPG’s 2015 acquisition of IVC Industrial Coatings and, during that same year, Kraton Performance Polymers, Inc.’s acquisition of Arizona Chemical Holdings Corporation’s highly-complementary line of high-value performance products and specialty chemicals derived from non-hydrocarbon, renewable resources.

Acquisitions Outside of Adjacent Market Segments

For long-term strategic reasons, a company may decide to make an acquisition completely outside of its traditional market space. A good example of this was DuPont’s 1999 acquisition of Pioneer Hi-Bred International Inc., the United States’ largest seed company. This purchase, coupled with DuPont’s rumored interest in selling its Performance Chemicals Division, seemed to signal an interest by DuPont in moving from its traditional petrochemical-based businesses into food and bio-based materials, an entirely new market space. As we have seen in the years since this acquisition, this is exactly the strategy that DuPont was pursuing.

Non-strategic Acquisitions by Private Equity Firms

Activity of this type tends to ebb and flow, depending largely on the economy and the multiples at which specialty chemical producers are selling. This market space is never far from the thoughts of private equity firms, however, because they consider the spectrum of specialty chemicals businesses such as paints and coatings; adhesives and sealants; home care products; synthetic lubricants; household, industrial and institutional cleaners (“HI &I”) and a few others to look particularly attractive in the long-term, since the need for all of these types of products is on-going and slowly increasing. Activity by private equity firms tends to get aggressive when companies are flush with cash. They like fragmentation and complexity, and they tend to be dry-eyed, rather than emotional, in their assessment and planning process.

Some private equity firms purchase a company, attempt to make it more profitable by slashing and burning, and/or loading it with debt; sometimes this works, but sometimes all they succeed in doing is in destroying equity, rather than creating it. This approach is in general disfavor, although it does occasionally happen.

Generally speaking, the private equity firm expects to own the acquisition for approximately five years, during which time it will do whatever is necessary to increase its value so that it can be sold at a significant profit. Typical approaches to increasing value, following the purchase of a desired company, involve selling-off undesirable product lines, services or facilities to generate cash and make the company more profitable. The acquiring company may:

Treat the new purchase as a stand-alone company, which—with better management—will turn into a winner that can be sold at significant profit.

Configure the new purchase as a “platform” onto which it can purchase “bolt-ons”—smaller companies in the same general market space that will create greater critical mass, and enable the platform to produce lower-cost, higher-quality products at greater profits levels, thus increasing the value of the company.

Often bring in ERP and MRP systems to help the platform and bolt-on companies become more integrated and smooth-functioning, thus creating even greater value, so that it can eventually be sold to a strategic company in the same market space or can be taken public.

How Are Mergers & Acquisitions Facilitated?

A number of entities may be called upon to assist the acquiring company in deciding upon, and making a successful bid for, another company, depending upon a variety of factors, including—but not limited to—size of both the acquiring company and the enterprise that it is hoping to acquire; type of financing that is being contemplated; whether the acquiring company already has a specific corporate target in mind or a specific group of target companies; whether an acquiring company has only certain types of companies in mind, or even certain types of market segments that it feels would be attractive.

On the “buy” side, a client may want to purchase:

- A specific type of business that provides products based on technology that it wishes to add to its portfolio.

- A company that conforms to very specific ideas about what type of enterprise it wishes to purchase—e.g., not just a company that specializes in polyurethane coatings, but one that specializes in polyurethane topcoats for commercial aircraft.

- A company with a specific business culture—e.g., a “family atmosphere,” that has been successful, has a good name, and that it would prefer to provide resources to, so that the business can grow, while retaining the original management team that made the company successful in the first place.

In all three of these “buy-side” scenarios, the buyer typically seeks the help of a specialized, highly-knowledgeable outside firm in identifying appropriate candidate acquisition companies of the type for which it is looking.

On the “sell” side, a company may be interested in selling, but only under specific conditions or to specific types of new owners. For example:

- A privately-held company may wish to be sold to a strategic buyer in its own area, so that it can be integrated into a larger organization that does basically the same things that it does, but on a larger scale, and with greater access to capital resources.

- A company in “selling” mode may want a new owner with a certain business philosophy or corporate culture that is compatible with the selling company’s philosophy and/or culture.

- On the other hand, a company may specifically wish to be sold to a non-strategic buyer—perhaps to an equity firm that will help it become a stronger company with an infusion of capital and improved business practices, prior to selling them in five years or so.

There are many other reasons and preferences of companies that either wish to acquire or be acquired—and all require assistance from knowledgeable, unbiased third-party experts.

These various types of acquisition goals may involve investment bankers; industry “matchmakers”; independent third-party experts to perform various aspects of “due diligence,” whether it be financial, technical, or production-related; regulatory; HR; tax/accounting; sales or marketing-related; HS&E-related or legal. Different firms specialize in different aspects of merger and acquisition facilitation. In general, the acquisition process unfolds as follows:

Due Diligence

Once a potential merger or acquisition has been identified, the acquiring company enters into a relationship with the acquisition target under which certain documents—financial, technical, commercial, legal, and regulatory—are made available to the potential acquiring company and its agents for the purposes of evaluation and investigation. These by no means constitute all documents of potential interest or value, so the acquiring company is well-advised to act upon this information with caution. For this reason, it generally hires unbiased, third-party firms to evaluate, and render opinions upon, the financial stability of the target company; soundness and focus of its technology base and current products; quality of products; extent and responsiveness of technical service; production capabilities and limitations; market analysis surrounding the current and likely future needs for its products; commercial aspects, including current market share of certain products, product lines, and market sub-segments; compliance with HS&E legal requirements as well as the robustness of the overall HS&E system; product claims history and certain other aspects of the business that have the potential to influence “To Buy” or “Not to Buy” decisions.

A quick look at the types of determinations that third-party firms are asked to make with regard to any potential Justice Department or FTC “triggers” that could come into play and disrupt—or seriously delay—the potential acquisition should give the reader a flavor for the type of potential situations that are evaluated by outside firms performing due diligence.

For example, the FTC considers the Herfindahl–Hirschman Index (“HHI”) to be one critical measure when considering whether or not to object to a potential acquisition or merger. The HHI is calculated by taking the sum of the squares of the two companies’ market shares which, based upon ChemQuest’s experience, cannot exceed 1000 for any given product market without raising questions.

Example 1: If Company A’s market share is 30% and the company that it wishes to acquire has a market share of 5%. Following the formula, (302=900) + (52=25) =925, which is <1000, and does not cross the HHI threshold.

Example 2: If, on the other hand, Company B’s market share is 31% and the company it wishes to acquire has a market share of 6%, then (312 =961) + (72 =49) =1010, which is >1000, and would set off alarm bells.

Even if a proposed acquisition/merger passes the HHI litmus test, there is a second, more specific, litmus test: The merged companies are not allowed to be in a position where they could raise prices 5% in any given year and make it stick. To be absolutely clear: the Justice Department has a highly-vested interest in making sure that the merged companies cannot raise prices by 5% in any given “product market,” which can represent a product line, brand, or even an SKU in any end-use or geographical area, sometimes down to the zip code level. (The narrowness of the geographical area generally relates to the number and type of file complaints received by the SEC.) This is meant to prevent the newly-merged company from exercising essentially monopolistic practices either locally or regionally, even though it may not be able to do so on an overall national level.

The investigation necessary to obtain this assurance is often referred to as the “(2X)Y test.” Here the equation used is: 2(Company X market share) x (Company Y market share) =≤250

Example 1: Company X’s market share is 24%, and the company that it wishes to acquire (Company Y) has a market share of 5%. So 2 x 24=48; 48 x 5 =240; this would pass the “250 points or less” test.

Example 2: Company B’s market share is 26%, and the Company Y that it wishes to acquire has a market share of 6%. So 2 x 26=52; 52 x 6=312; this would not pass the test, and would send up alarm bells.

Triggering an alarm at this stage is not a good thing, because it sends the Justice Department a signal that will be viewed with an extremely jaundiced eye, and could easily tie-up the process for 8–12 months. For those of us in the business, failing the (2X)Y test is often thought of as the “KOD” (Kiss of Death), but things are not always what they appear to be on the surface, and it sometimes happens that acquisitions/mergers at first appear to present the potential for some form of monopoly which, upon further investigation, is not supported by the facts.

An example of this type of concern occurred when Rohm & Haas acquired Unocal. R&H had the #1 position in acrylics and Unocal had the #1 position in vinyl acrylics, and the government was very concerned that they would basically “own” the two components that were frequently mixed by formulators to produce finished products. This was resolved, however, because R&H was able to show that exactly the same reactors that make acrylics are able to make vinyl acrylics (on the same day, if necessary), so the industry would be self-regulating. Any competitors who made either acrylics or vinyl acrylics could do the same thing, and switch their product mix at will. Therefore, the merger of R&H and Unocal did not have the potential to “lock up” the production of both resins.

Paying for an Acquisition: The Concept of Multiples

The term “multiples” is inexorably associated with mergers & acquisitions, and simply refers to the “multiplier” that will be used, generally with some aspect of earnings, such as EBIT or EBITDA, but it could also involve annual sales revenue, or any other financial figure that relates directly to the overall health of the business to be acquired.

For example, if Company A considers that purchasing Company B is a good investment if they can purchase Company B for 6X its average EBITDA over the past three years, then its offer would involve paying a “multiple of 6” EBITDA for the proposed acquisition.

Multiples in the paint and coatings segment and closely allied businesses such as adhesives, as well as the raw material market segments that provide products to both businesses, were severely depressed over the three to four-year period following the onset of the Great Recession, which nominally ended in June/July of 2009. Prior to 2008, paint and coatings suppliers were selling at multiples in the range of 8–9X EBITDA, and adhesive companies were selling at 10–12X EBITDA but this came to an end with the Great Recession of 2007–2009, and dropped to the neighborhood of 5–6X for coatings, and 7–8X for adhesives. As things continued to recover, however, the multiples began creeping up. By 2012 multiples in the coatings industry had risen into the range of 7–7.5X and in the adhesives industry into the 8–9X range. By 2016 multiples had reached 9–14 for the coatings industry, and were trading in the range of 11 to 16 in the adhesives industry.

When all is said and done, multiples tend to be a “quick and dirty” way of determining how an industry is viewed by the financial community and industry, in general. They are only one measure, of course—but they are an important one.

Why Do So Many Mergers & Acquisitions Fail to Produce the Desired Results?

An informed estimate would be that somewhere between 50–80% of mergers and acquisitions fail to produce the desired results. There are many reasons for this—too many reasons to go into in this article. Suffice it to say that, no matter how much “Company A” thinks that it knows about “Company B,” it can never know enough. Two factors are the most likely to cause disappointment, however:

- Cultural Issues—When companies merge, they bring together employees who have different priorities and different ways of thinking about—and performing—their jobs. These differing cultures inevitably lead to confusion and frustration among the staff, noncompliance with requirements and regulations, various responsibilities that “slip through the slats,” and higher costs of business due to operating inefficiencies.

- Lack of Insight into the “Success Factors” of the Company Being Acquired—At the highest levels of the acquiring company, there is often a lack of true understanding regarding why the company that is going to be acquired is so successful. A classic example, with the names withheld to protect the participants, will serve as a cautionary tale:

- Company A was a direct competitor of Company B, and supplied exactly the same types of products, based upon the same generic technologies and also applied as primer + topcoat systems, to the same end-users and subject to the same warranty conditions.

- Both Company A and Company B were very successful and very profitable, and the assumption was that if Company A purchased Company B’s technology and customer list, without purchasing its plants or equipment, Company A could add Company B’s business to its own on an incremental basis, and would generate sales equal to that of Company A and Company B combined and make even more profit than the separate profits of Company A and Company B added together.

- Company A supplied coatings based upon a variety of technologies, but they all had one thing in common: it supplied primers and topcoats, and they were always used as a system, as a condition of the warranty.

- So far, so good. . . HOWEVER, since Company A and Company B were competitors, they had many customers in common, who used one of them as a principal supplier, and the other as a back-up supplier, just to “keep the principal supplier honest.”

- When the two companies merged, the customers that they had in common were not happy campers, because they now had only a single source of supply, and suddenly lost their leverage.

- Result? They brought in Company C as a new supplier, which seriously cut into the sales revenue of the combined Company A+B, and also reduced its overall profit. Company A+B could have lived with this, because when two companies merge, they always plan for a certain amount of lost business, although it is virtually never a realistic number. . . (Hope, as they say, springs eternal.)

- What Company A+B couldn’t live with was the situation that developed almost as soon as the ink was dry on the acquisition. Company A and Company B may have made the same types of products using the same type of equipment and sold these products to the same customers, BUT they did not make their money in the same way.

❍ Company A made almost all of its profits from the sales of its primers, which were priced very high, and very little of its profits from its topcoats, which were priced very low. Since they were always sold as a system, the customers didn’t care about the individual prices, as long as the total price of the system, on a square-foot basis, was competitive.

❍ Company B, however, made its profits in just the opposite way—it charged a lot for its topcoats and sold the primer at a very low price.

At this point, the reader is probably wondering why the customers didn’t just purchase primer from Company B and topcoats from Company A, even when they were separate companies, to get the best possible overall system price. The answer is because these coatings were very high-end systems with extremely long-term warranties, and neither company would offer a warranty unless its own primer was used under its topcoats.

When Company A purchased Company B, however, it now owned both sets of primers and topcoats, so the mutual customers began purchasing the inexpensive primers formerly made by Company B and the inexpensive topcoats formerly sold by Company A, and then demanded the same warranty coverage since all products now belonged to Company A, which was the “warranty granter.”

The result? Company A, which had hoped to increase both its sales and its profits through the acquisition of Company B, instead lost both sales and profits—in fact, its profits dropped significantly below what the combined profits of Company A and Company B had formerly been on the same volume of sales.

“Synergy”—The Pursuit of the Elusive by the Desperate

A quick word about “synergy,” which is often used to justify mergers and acquisitions, is in order:

- If used in a business application, “synergy” means that teamwork will produce an overall better result than if each person within the group were working toward the same goal individually.

- It is also used to suggest that multiple divisions within the same company—or two companies with complementary strengths—should be able to produce an overall better result than if each division or company were working separately.

I have worked in industry for over 45 years, however, and have only rarely seen bona fide examples of “synergy at work.” Why is this? Again—too complex to go into any real degree of detail in this article. A few things to consider, however:

- The concept of group cohesion—that property that is inferred from the number and strength of mutual positive attitudes among members of the group—is the basis of the belief that synergy is real and can be achieved. Unfortunately, there are virtually always negative aspects of group cohesion that have an effect on group decision-

making and, consequently, on group effectiveness. - One of these negative aspects of group cohesion is the “risky shift” phenomenon, which is the tendency of a group to make decisions that are riskier than the members of the group would have recommended individually. This phenomenon is frequently seen in action . . . but only rarely does it lead to success.

- Another negative aspect is “Group polarization,” which occurs when individuals in a group begin by taking a moderate stance on an issue regarding a common value and, after having discussed it, end up taking a more extreme stance. Not good—witness today’s political scene.

- Yet another typical negative consequence of group cohesion is what George Orwell so presciently referred to in his great novel, 1984, as “group think”—a mode of thinking that people engage in when they are deeply involved in a cohesive group, and their desire to be “team members” tramples both their good sense as well as their motivation to realistically appraise the alternative courses of action.

Pilcher’s Axiom: There is no such thing as synergy in business, and—if you believe that there is—it is quite likely that you have seen unicorns in the flesh and truly do believe that “the check is in the mail.”

Post-Recession M&A Activity

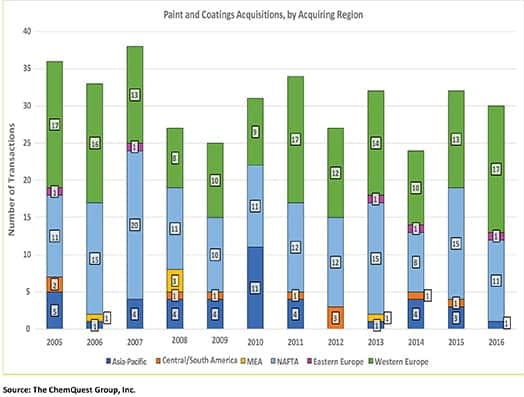

After dropping significantly in 2008 and early 2009, global acquisition activity in the paint and coatings market sector began picking up (Figure 1). However, the activity has been halting, and has not reached pre-recession levels, at least in numbers of acquisitions, which have leveled at 32 (plus or minus) since 2010. (One suspects that the values of the acquisitions have grown, but meaningful numbers are in extremely short supply.)

It is of interest that M&A activity in 2011 (Figure 2), which was characterized by a large number of small acquisitions, occurred early in the year, and then began to tail off. This was largely due to uncertainty about the future, both that of the very slowly recovering U.S. economy, as well as the flagging economies of both Europe and the PRC. Uncertainty breeds caution, which led to changes in the way in which money was made available for merger and acquisition activity. As a result, lending organizations changed their guidelines, and also began adding performance covenants to the conditions of the loans. For example, a loan for an acquisition that would have been fairly straightforward prior to 2008, might now contain language requiring that the acquiring company provide more equity, as well as achieve a certain level of gross profit margin.

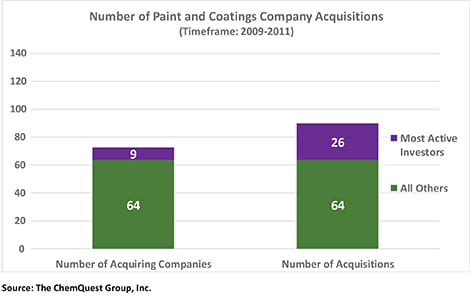

As can be seen in Figure 2, the lingering economic improvement in the United States following the Great Recession by no means brought M&A activity to a halt, but it definitely had a dampening effect.

- Of the 90 transactions, made by 73 companies, that took place during the three-year period 2009–2011, 26 (29%) were made by a total of nine companies (12%), and the remaining 64 transactions were all individual transactions made by the remaining 64 companies.

- From 2009–2011, a number of smaller niche firms were part of those nine companies.

- During this period, the pace of large-company acquisitions decreased somewhat. The M&A activity was basically a case of small firms acquiring—or merging with—other small firms, generally in market areas that were closely aligned to their core business.

- At some point in the future, it is likely that many of those newly-

merged firms will be acquired by larger firms when they reach a geographical or technical critical mass, and the larger, cash-rich companies become less cautious as a result of a continually improving economy.

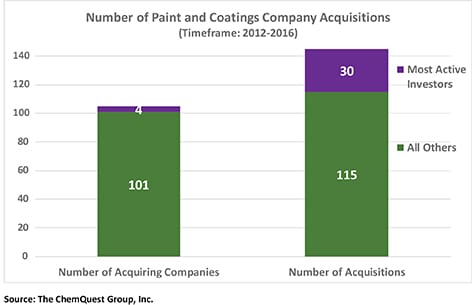

By contrast, the number of transactions that took place during the five-year period 2012–2016 (Figure 3) was 145, representing activity by 105 different companies, four of which (4%) were responsible for 30 of the transactions (20%). These 145 transactions represented a minimum of $5Bn (public records are either silent or incomplete on dollar values of these transactions), of which $3.5Bn (70%) were attributed to PPG’s acquisition of Comex (Mexico), AkzoNobel’s U.S. architectural paints business, and Dyrup (Denmark).

The pace of large companies making acquisitions has increased during this period of time.

As the economy slowly continues to improve, M&A activity will continue to grow, although less so in the paint and coatings area, where many smaller companies have already merged or been acquired, than in adhesives and sealants, where the market space is still extremely fragmented, and there are plenty of opportunities for consolidation.

Since the Sherwin-Williams/Valspar merger was begun in 2016 but is likely to play out in 2017, it is a reasonably safe bet that, sans Justice Department intervention, 2017 will be a banner M&A year, at least with regard to value, for the paint and coatings industry.

Important Takeaways

The rate of consolidation decreased significantly in 2009, following the financial crisis that began in December of 2007.

- By 2010, however, both the number of transactions, as well as the value of those transactions, was already beginning to normalize.

- Small-to-medium–sized companies that have been growing through acquisition will probably themselves be acquired by larger firms when they reach a geographical or technical critical mass.

- Spin-off opportunities for other companies will be created as a result of government competitive regulations in industrialized regions.

- Large acquisition opportunities will continue to present themselves as conglomerates operating in the coatings space reevaluate their portfolio of businesses, and as an improving economy mitigates the current sense of caution.

- We are already seeing some of this activity—e.g., in March of 2016, Sherwin-Williams announced its plans to purchase Valspar for $11.3Bn, which represented a multiple of 15X projected 2016 EBITDA (11X after accounting for a projected $280MM in synergies) and a 41% premium on Valspar’s closing price on March 18, 2016.

CoatingsTech | March 2017 | Vol. 14, No. 3