By , The ChemQuest Group, Inc.

We all lived through the Great Supply Chain Crisis of 2022, and most of us lived to tell about it. While we would all like to think “that can never happen again,” the fact is that it is exceedingly likely that it not only can happen again, but that it will happen again. As we sit here three years later, the real question should not be “Will such a supply chain disaster ever occur again in the future?” but rather, “When will the next supply chain crisis hit the global manufacturing network?”

Following the Great Supply Chain Crisis, a lot of action was taken to prevent such an event in the future—action by businesses, both small and large; local and state governments; governments of countries around the globe; cooperative organizations such as the World Bank; and global non-profit organizations such as the Red Cross. A lot was learned, and a lot of the learning that was applied to the various areas of business, government, and global cooperative organizations was of a very positive and proactive nature and would certainly help to stabilize the global supply chain in the event of another unexpected event, such as COVID or a similar event destined to affect the entire global community and wreak havoc with the complicated arteries of commerce that carry the lifeblood of the global economy in them. What if, however, the next situation that negatively affects the global supply chain is neither sudden nor expected? What if, instead, it is a predictable set of circumstances that we know will cause such a problem, but which we cannot predict with regard to when it will have an impact? For the answer to this question, we simply need to look at the world around us in 2025. Whether ongoing tariffissues, the war in Ukraine, threats by Iran to close the Strait of Hormuz, cybersecurity controls, or the decision by Saudi Arabia to lower crude prices in search of market share, all companies are affected in some way, and to some degree, by those issues that affect global trade and which have already created a variety of negative situations for global industry participants. This is news everywhere, and on the lips of all.

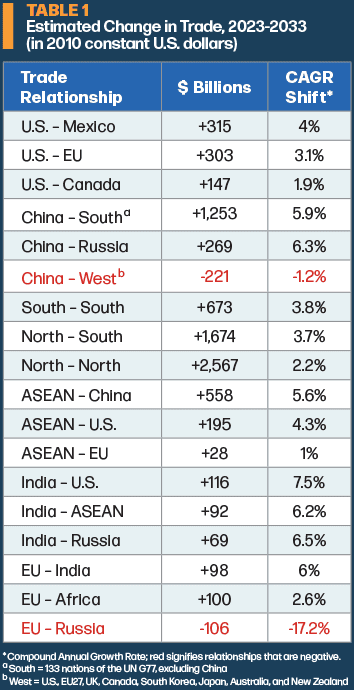

On the largest scale possible—global trade—we are seeing the early stages of what are likely to become major shifts in the years ahead, with regard to “who trades with whom” and how this will affect global regional trading patterns. For example, it is highly likely that there will be decreased trade between both North America and the European Union (EU) with China, but increasing trade between North America and the Association of Southeast Asian Nations (ASEAN)—and both the EU and North America will be increasing trade with India and selected other countries in the “Global South,” such as Mexico, Brazil, Thailand, Vietnam, Nigeria, and Egypt (Figure 1 and Table 1).1

FIGURE 1 Anticipated world trade trends.

The hard truth about the current worldwide economic scenario is that global supply chains are more fragile than ever, and everyone in the paint and coatings industry must be diligent about applying the lessons that they learned from the Great Supply Chain Crisis of 2022 to everything that they are doing today, while also preparing to react as quickly as possible to news from around the world that might affect both the supply chain and their individual businesses. At the end of the day, we are all going to need to consider some version of reshoring (and/or nearshoring, friendshoring, ally-shoring) to secure critical raw materials and control the cost of shipping. We are already seeing various steps being taken to reduce dependence on Chinese specialty chemicals, and this must continue into the future, being careful not to “cut off our nose to spite our face.” A China that is a friendly trading partner will always be preferable to a China that is a potential adversary.

The Relationship of Crude Oil to the U.S. Paint and Coatings Industry, 2023–2025e

Understanding what is happening now and what is likely to happen in the near- and longer-term future of crude oil production is necessarily an important component of the creation of meaningful strategy for paint makers worldwide. We must always bear in mind that every $10 increase in crude results in a 3% increase in overall costs to coatings producers, representing an important factor in the overall dynamics and profitability of the paint and coatings industry.

Continue reading in the September-October digital issue of CoatingsTech