By Cynthia A. Gosselin, Ph.D., The ChemQuest Group

Electrification has been a hot topic for the last few years. The aging power grid where 30% of electric lines are approaching their typical 50- to 80-year lifecycle, leading to brownouts in the western United States. Artificial intelligence (AI) advancements that require exponentially more power than traditional data centers, crypto mining, and a growing population that is using more and more electronics are causing hook-up bottlenecks, particularly for clean energy, large users, new technologies, and an increasing number of consumers.

Adding to these needs, the North American Electric Reliability Corporation predicts that rising peak demands, projected capacity deficits, fuel vulnerabilities, and insufficient dispatchable resources are risks to the availability of power if growth of transmissible power stalls. The ever-increasing energy needs and the vulnerability of our current resources have Microsoft partnering with Constellation Energy to reopen Unit 1 at the Three Mile Island nuclear plant as the Crane Clean Energy Center to provide enough power to operate their projected AI data warehouses.1

On October 18, 2023, the U.S. Department of Energy (DOE) announced up to $3.5 billion for 58 projects across 44 states to strengthen grid reliability nationwide.2 In order to achieve these goals, it will be necessary to manufacture a significantly larger number of transformers and generators. Each of those pieces of equipment will require electrical steel laminations with highly specialized coatings to meet power requirements, insulation levels, durability, corrosion resistance, and temperature resistance to improve energy efficiency.

This projected growth is so important to the national economy that Cleveland Cliffs, a large producer of electrical steel in the United States, announced plans in 2022 to repurpose a shuttered tin-plate facility to produce state of the art electrical transformers in Weirton, WV.3 Lourenco Goncalves, chairman, president, and CEO of Cleveland Cliffs, has emphasized the critical shortage of electrical transformers and its impact on economic growth throughout the country. He has famously stated there will be no AI without electricity and there will be no electricity without transformers.

The global electrical steel coatings market was valued at $304 million in 2023 and projected to grow at a 5.3% CAGR to $490.3 million from 2024 to 2032. Growth will be driven by an increasing need for energy-efficient transformers and electric motors as industries strive to reduce energy losses and meet various environmental regulations. The chromium-containing segment is currently 42%, with the C-5 coating segment valued at $198.1 million.4 North America is a prime market due to industrial automation, growth in the EV market, high consumer spending, industrial technology advancements, and the competitive growth of energy-devouring AI initiatives.

Grain Oriented Electrical Steel (GOES) has the largest market share because it can generate magnetic flux while at rest and not rotating. This is the best electrical steel for large, high-performance generators and energy-efficient and traditional transformers because of superior magnetic properties. GOES exhibits lower core losses, strong magnetic directionality, and superior magnetic permeability (amount of magnetization produced in response to a magnetic field). Grains are parallel to the rolling direction. Absolute magnetic properties are dependent upon the heat treatment imparted during production.

Non-Oriented Electrical Steel (NOES) is used primarily for rotating equipment such as electric motors, generators, and over-frequency and high-frequency converters. Both types of steel chemistries contain varying levels of iron (93–98% by weight), silicon (1.2–3.5% by weight), and chromium (0–1.5% by weight). Trace elements of raw materials and/or alloying elements are also present, including aluminum, boron, calcium, carbon, columbium, copper, manganese, molybdenum, nickel, phosphorus, sulfur, titanium, and vanadium.5 Electrical steels are coated according to ASTM A976-18 Standard Classification of Insulating Coatings for Electrical Steels by Composition, Relative Insulating Ability, and Application.

Electrical steels are sold as either semi-processed or fully processed. The main difference is that semi-processed steels receive the final heat treatment subsequent to punching into the required shape while fully processed steels are sold with an insulating coating, full heat treatment, and specific magnetic properties.

Rembrantin, Axalta, and Chemetall are well-known global electrical steel coatings suppliers, and Henkel provides a product within the United States. All have recently increased their offerings to include chromium-free and/or formaldehyde-free alternatives to meet current or potential environmental regulations.6,7,8

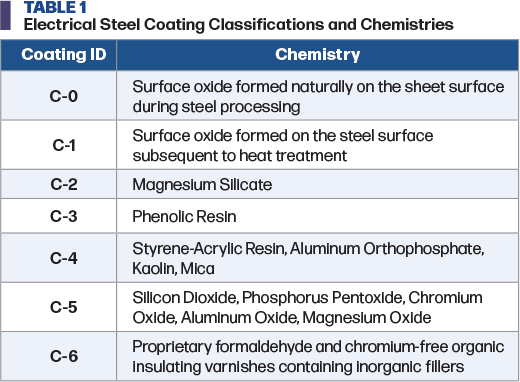

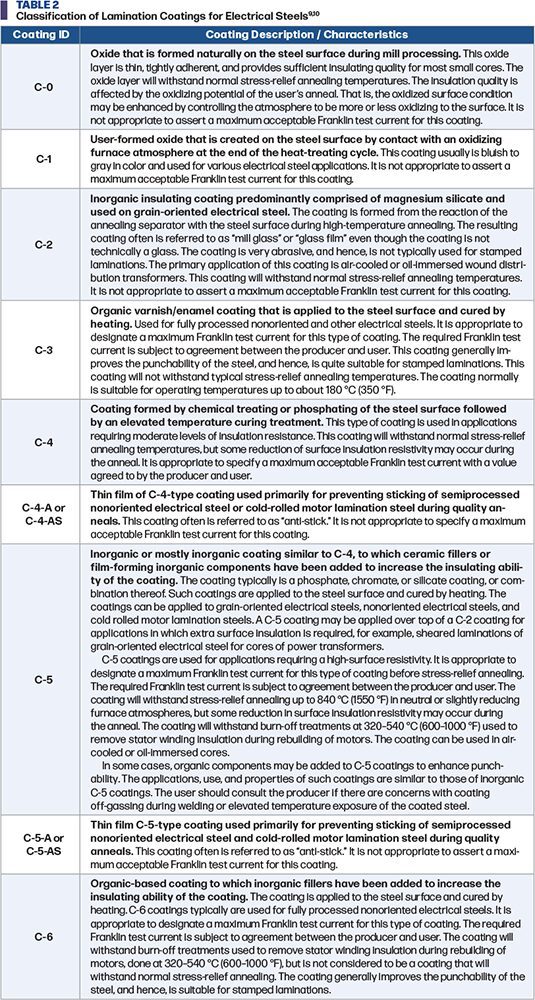

There are nine categories of electrical steel coatings currently documented in ASTM A976. Table 1 lists the chemistries of the various coatings. Table 2 provides a description of the coating characteristics for each classification.

The electrical steel coatings market has been growing over the past few years and is slated to play an ever-increasing leading role in the facilitation of all aspects of electrification equipment for upgrading the power grid, enhancements for AI power generation, and clean energy initiatives in the industrial sector.

, Ph.D., is director at The ChemQuest Group, www.chemquest.com. Email: cgosselin@chemquest.com.

References